Research Insights: Israel – Gaza (Palestine) conflict

Background

The historic dispute of middle eastern territories between Israel and the State of Palestine became destructive on October 7th as the Palestinian militant group, Hamas, launched what has been labelled as a “terrorist attack” on Israel resulting in more than 1,400 Israelis being killed. In addition, Hamas took an estimated 230 Israeli soldiers and civilians hostage. Not surprisingly, an ongoing military retaliation against Hamas has ensued mainly involving air strikes against Hamas targets. The situation has been further complicated by the involvement of Lebanese Shia Islamist political party and militant group, Hezbollah. Both Hamas and Hezbollah are funded by Iran which has incentivized the U.S. to send troops to the region in a show of support for Israel and the US has been involved in bombings of facilities used by Iran’s Islamic Revolutionary Guards Corps and other Iranian proxies in neighboring Syria.

On the weekend the conflict escalated with Israel commencing a ground war in Gaza, the largest city in the State of Palestine. Unfortunately, as the conflict escalates the tragic loss of civilian lives is also escalating. The loss of basic needs such as power, water and food is further exacerbating the hardship as humanitarian aid to Gaza is being stymied by border access and a lack of safe access to impacted areas.

Implications

There are many potential implications resulting from this conflict notwithstanding the Russian-Ukraine war is still ongoing after 20 months, all of which is creating an unstable global environment. The degree to which the Israel-Gaza conflict diverts attention away from Russia’s invasion of Ukraine is uncertain but does have the potential to test the resolve of those nations supporting Ukraine. Providing support in various forms (military presence, funding, troops, military hardware) to both Ukraine and Israel potentially leads to governments having to ration support as the public interest in international conflicts wanes, particularly if cost of living pressures mount and economic growth slows.

Security of supply issues for oil are increasing given the uncertainty of how the Israel-Gaza conflict plays out. As a result, the price of oil has increased and has the potential to move even higher. A sustained increase in the price of oil will have global implications such as increased costs, higher inflation and ultimately higher cash rates that could stall economic growth.

During times of heightened geo-political uncertainty investors tend to adopt a more cautious, “risk-off” stance. Profit taking in growth assets such as equities and property occurs, and investors are happy to hold more cash to take advantage if investment markets move lower. US dollars and gold, typical investment havens, have appreciated in value due to increased investors interest.

Conclusion

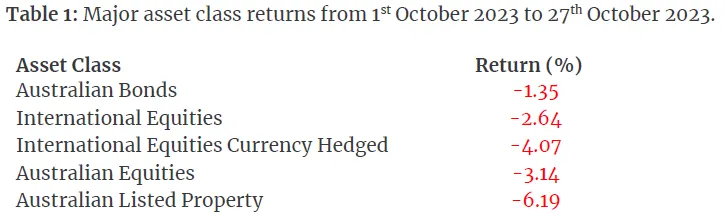

Over the last 18 months investors have had to grapple with a “higher for longer” outlook for interest rates which has seen implied investment valuations change. The Israel-Gaza conflict is likely to add to volatility in investment markets in the near term and in October investment markets have sold off as shown in the table below.

It is normal to feel heightened levels of anxiety during periods of increased geo-political conflict. However, the longer-term strategy of having a well-diversified and liquid portfolio of assets is something investors should focus on.

These volatile periods in investment markets have the potential to provide significant misalignments in asset valuations and also provide opportunities to take advantages of such misalignments. However, the environment has the potential for investors to make emotion-based decisions in the short-term which negatively impact their potential returns over the longer term. Investors should remain patient and refrain from knee-jerk, emotion-based changes to asset allocation.

Article source: Australian Unity

This information has been produced by Australian Unity Personal Financial Services Ltd (‘AUPFS’) ABN 26 098 725 145, of 271 Spring Street, Melbourne, VIC 3000, AFSL. Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Nothing in this document represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product. A PDS can be obtained from your financial adviser or directly from the product issuer. We make no guarantees regarding future performance or in relation to any particular outcome. Past performance is not indicative of future performance. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and AUPFS and its related bodies corporate make no representation as to its accuracy or completeness. Published: November 2023 © Copyright 2023