Market Commentary April 2024

In April equity markets reflected a change to valuations as the likelihood of cash rate cuts in 2024 lessened and investors began to factor in a “higher for longer” interest rate backdrop. Broadly speaking international and Australian equity markets were weaker by around 3% and Australian Real Estate Investment Trusts (AREITs) after rising by 10% in March sold off by 8% in April, reflecting the higher for longer bond rate thematic.

What were the catalysts for a move to a “higher for longer” cash rate regime?

US inflation increased over the year by 3.5% led by increases in energy prices, mortgage rates and rental rises. US retail sales increased more than expected led by online retailers providing further evidence that the US economy is solid with no real signs that high cash rates are denting consumer confidence and economic growth.

In Australia inflation came in at 1% for the quarter to the end of March – ahead of consensus expectations. Whilst the annualised inflation rate is falling it’s still at 4%, which is above the RBA’s 2-3% target band. Unemployment weakened slightly in March to 3.8%, however the labour market is still tight. The robustness of the Australian economy has led to many economists predicting further rate hikes in the months ahead. The RBA next meets on the 6-7th May.

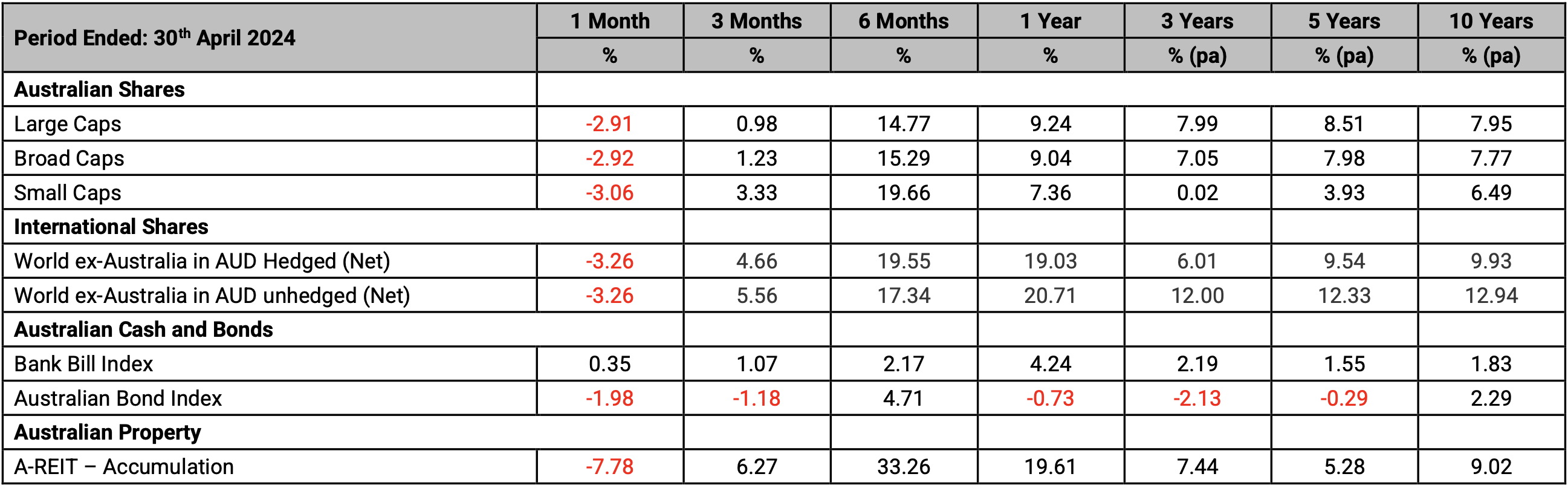

Australian large cap Equities fell by 2.9% with only utilities and materials having positive returns in the month. Hedged global equities fell by 3.2% whilst unhedged global equities also fell by 3.2%, the Australian dollar was relatively flat in April buying US$0.6561. US equities were a large contributor to global stock markets being down, with the market darling Nvidia falling close to 20% intramonth to end the month down around 7%.

Both the Australian 2-year government bond yield and the 10-year government bond yield increased by 42bps to close at 4.42% and 4.10% respectively. The US 10-year government bond yield rose by 48bps to close at 4.69% and the US 2-year government bond yield rose by 42bps to 5.05%.

Benchmark Returns

Article source: Personal Financial Services Ltd (PFS)

Disclaimer: Research Insights is a publication of Personal Financial Services Limited ABN 26 098 725 145 (PFS). Any advice in this article is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making product decisions. Where appropriate, seek professional advice from a financial adviser. Where a particular financial product is mentioned, you should consider the product disclosure statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Ltd (PFS) and its related bodies corporate make no representation as to its accuracy or completeness.