Sharemarket Volatility Return for 2018

Be alert, not alarmed, as the prospect for global sharemarkets remains positive.

Sharemarkets, so far in 2018, are providing a contrast to the robust returns enjoyed by investors in 2017.

The Australian S&P/ASX 200 Accumulation Index returned -3.9% for the March quarter, Japan’s Nikkei 225 Index finished the March quarter with a return of -5.8% (denominated in Japanese Yen) and the United Kingdom’s FTSE 100 Index fell 8.2% (denominated in British pounds).

Not only has there been an across-the-board decline in these sharemarkets but there has been a significant rise in volatility from the historically low levels experienced in 2017 where markets felt as though they smoothly tracked upwards.

What has changed?

A number of factors have been responsible for the return of volatility… and the unease it causes investors.

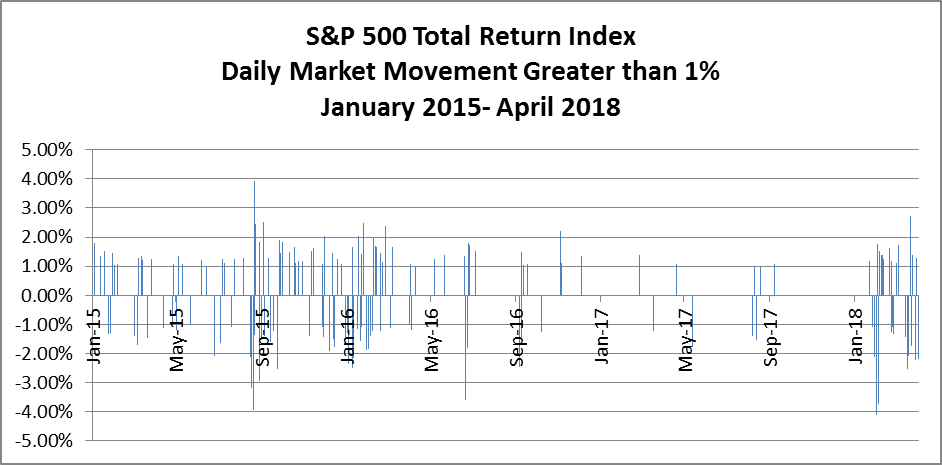

Chart 1: Sharemarket volatility was abnormally low during 2017

For investors, 2017 was characterised by two features: robust investment returns and very low volatility. Given an unconventional 45th President of the United States was inaugurated at the start of 2017, and the year was characterised by significant geopolitical events that had the potential to impact on any given trading session, the year was remarkably kind to investors.

Only nine trading days in 2017 (in the United States) saw daily market movements greater than 1% (positive or negative). In contrast, this occurred on 73 trading days in 2015. Year to date in 2018 (up until 12 April) there have already been 28 occurrences, as shown in Chart 1.

Often near-term experiences do colour our perspective of what is “normal”. Last year is our near-term experience characterised by low market volatility and high investment returns; it clearly is not an appropriate “yardstick” year and should be viewed as an exception rather than the rule.

Indeed what we have experienced so far in 2018 is closer to ‘normal’ conditions as opposed to being abnormally high. Nonetheless the return to more normal levels of volatility has naturally increased investor discomfort in 2018.

Geopolitical concerns are ever-present

At any point in time there are always geopolitical concerns around the globe. Today there are plenty of issues causing consternation for investors. Among those at the forefront of investors’ minds are: the unpredictability of North Korea’s Supreme Leader Kim Jong-un; the relationship between Russia and the rest of the world; the potential for a trade war between the United States and China; a number of different concerns relating to US President Donald Trump; and the ramifications of Brexit.

A confluence of events at the beginning of 2018 served to increase focus on geopolitical and macroeconomic risks. These events included the US Federal Reserve highlighting the potential for three increases of cash rates in 2018, a move upwards in bond yields, the imminent change of the US Federal Reserve Chairman, and the start of the new year bringing asset allocation changes by many large managed funds around the globe.

Arguably geopolitical risks are more visible today than they have been in the past as politicians around the globe seek to exploit the 24 hour news cycle and publicly comment on a range of global issues that were often subject to limited public comment as diplomats worked behind the scenes to find solutions.

While not attempting to dilute the importance of these issues and their influence on financial market movements, investors should keep perspective. By that we mean investors should retain their focus on achieving their long term investment goals, rather than worry about issues that can cause increased volatility in the short term.

Are sharemarkets overvalued?

Taking a loner term view, we believe that a majority of the world’s leading sharemarkets (including Australia) are currently trading in the Fair Value – Fully Priced range.

The exception is the US stockmarket which we believe is potentially on the cusp of moving into the “Overpriced” range. Overall, this suggests the US stockmarket is more prone to underperforming other markets in the medium term.

The US economy and US corporate earnings in 2018 should be bolstered by tax cuts for both individuals and corporations. Earnings per share are expected grow around 18% in 2018. Contributions to this growth include lower tax, increased share buy-backs and growth in underlying earnings.

Offsetting this is likely lower tax revenues and an increase in the US budget deficit. This arguably makes the US economy more susceptible to any economic downturn in the future with a deficit that continues to grow and individual tax cuts expiring in 2025.

For Australia, the economic backdrop remains positive and should provide a solid base for our sharemarket going forward. However, there are headwinds, including increased geopolitical concerns, expectations of rising global interest rates, the Royal Commission into Financial Services, as well as the Labor opposition proposing changes to the utilisation of imputation credits for self-managed superannuation funds.

Volatility to be the norm, once again, but the general outlook for global sharemarkets is positive

In conclusion, global sharemarkets face challenges moving forward and it is too early to call an end to recent market volatility. Rather, it is more likely to be the norm rather than the exception.

However, the good news is the global economic outlook remains robust with synchronous global growth continuing, interest rates remaining at relatively low levels and employment growth continuing.

In some instances, share prices may have run ahead of underlying valuations or inadequately priced in risk, but the outlook overall remains positive for global sharemarkets.

Investors should remain alert, but there is no material reason to be alarmed.

Source: By Tim Schroeders & Jeff Mitchell, Investment Research Department – Australian Unity Personal Financial Services