Our take on the 2019-20 Federal Budget

On 2 April, the Federal Treasurer John Frydenberg delivered his first Budget which in many ways is structured as an election campaign pitch for the Coalition Government. Being a pre-election budget, its centrepiece is a $302 billion package of tax cuts for 10 million Australians and three million small businesses rolled out at different stages over the next 6 years. Other areas of focus include:

- A tax concession of $400 million to small and medium size businesses via the instant asset write-off provision

- A $100 billion National Infrastructure Plan

- A one-off, income tax exempt payment of $75 (for singles) or $125 (for couples) to certainPensioner and Allowees

- Funding for 80,000 new apprenticeships

- Record funding for the health sector including funding for hospitals, pharmaceuticals, medical equipment etc.

- Additional funding for schools as well as pre-school education.

It is important to note that the announcements made in the Federal Budget are only proposals and to become law, the Coalition Government will need to win the Federal election next month, and have the support of crossbench Senators. Changes can also be made prior to these proposals becoming law.

If you’d like to know more about these or other measures announced in this years’ Federal Budget please contact your Financial Adviser.

Tax

PERSONAL INCOME TAX CUTS

The tax cuts announced in this Budget builds on a raft of tax cuts initially announced and since legislated in the 2018 Federal Budget. In last year’s budget, the Low and Middle Income Tax Offset (LMITO) was introduced as an addition to the Low Income Tax Offset (LITO).

In the 2019 Budget, the LMITO base rate will increase from $200 to $255 and the maximum payment will increase from $530 to $1,080 for the 2018-19 to 2021-22 financial years. From 1 July 2022, the LMITO will be replaced by a single low-income tax offset (LITO). In this Budget the maximum rate of LITO is also increasing from $645 to $700 from 1 July 2022.

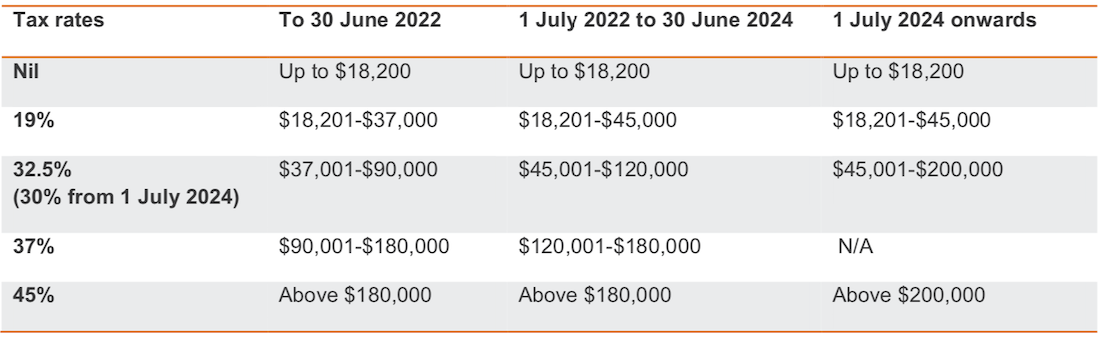

Over the next five years, many Australians will receive a decrease to their income tax rate in one of three ways:

- The upper threshold for the 19% marginal tax rate will increase from $37,000 to $45,000.

- The 32.5% marginal tax rate will reduce to 30%.

- The 37% marginal tax rate will be abolished (this change has already been legislated).

These changes will be progressively rolled out between now and 1 July 2024, as shown in the table below:

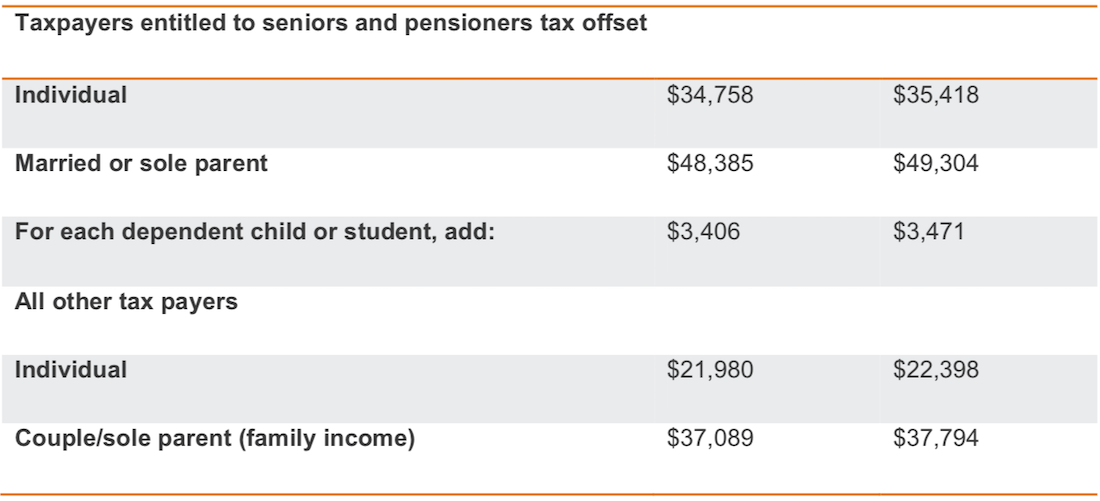

INCREASE MEDICARE LEVY LOWER THRESHOLD

The lower Medicare levy thresholds will be increased, meaning the levy will not be charged to you where your taxable income is below the thresholds below:

INSTANT ASSET WRITE-OFF

If you are a small to medium size business owner you will have access to an additional $5,000 under the instant asset write-off scheme, boosting the threshold from $25,000 to $30,000. Additionally, larger businesses will be granted access under the tax break, with businesses posting revenues of $50 million or less given access, an increase from the previous limit of $10 million or less. Applying on a per asset basis, eligible businesses can instantly write off multiple assets.

Eligible businesses will be able to immediately deduct purchases of eligible assets costing less than $30,000 that are first used or installed ready for use from 2 April 2019 to 30 June 2020.

Superannuation & Other

INCREASING FLEXIBILITY FOR OLDER AUSTRALIANS

Superannuation contribution rules will be softened allowing 65 and 66 year olds to make voluntary contributions without meeting the current work test. The same cohort will be permitted to make three years’ personal voluntary contributions, currently capped at $100,000 a year, to their superannuation account in one year. At present, only people under 65 can access these arrangements commonly referred to as the ‘bring forward’ rule.

The Government also intends to increase the age limit for spousal contributions from 69 to 74. At present, a person aged over 70 cannot receive contributions made by someone else on their behalf.

Voluntary contributions include after-tax (non-concessional) contributions, tax-deductible (concessional contributions), voluntary employer contributions and spouse contributions.

These changes will align the work test with the eligibility age for Age Pension (scheduled to reach 67 from 1 July 2023) and provide additional opportunity to grow your retirement savings.

FOCUS ON SKILLS & EDUCATION

The education sector will see a number of measures to improve long term employment outcomes, including:

- Additional 80,000 apprenticeships, achieved through incentive payments to employers

- Launch of a new foundational language, literacy, numeracy and digital skills program to provide individuals with the skills to move into further education or employment

- Establishment of 10 training hubs and 400 scholarships to help target youth unemployment

- Educating Australian children, parents and teachers on cyber-safety

- Recurrent funding for schools with average Commonwealth funding per student increasing from $3,755 in 2014 to $5,097 in 2019.

- Extending the National Partnership Agreement to Universal Access to Early Childhood Education until the end of 2020, ensuring every child has access to a quality preschool education for 15 hours a week in the year before school.

HEALTH & WELLBEING

- A Medical Research Future Fund which focuses on rare cancers and diseases, cardiovascular health, clinical infrastructure and stem cell research.

- Resourcing for mental health including a focus on young people, reducing waitlists for youth mental health services, addressing youth suicide and a range of new community support services.

- Initiatives to reduce domestic and family violence against women and children including added funding for the 1800RESPECT hotline ensuring it is able to meet forecast increases in demand, emergency accommodation for women and children escaping domestic and family violence and bolstering a range of existing support services.

Social Security & Aged Care

ENERGY ASSISTANCE PAYMENT

A one off tax-free Energy Assistance Payment will be paid to eligible singles ($75) and couples ($125) in receipt of a qualifying payment on 2 April 2019. The payment will be paid by 30 June 2019, helping with increased power bills. Qualifying payments include:

- Age Pension/Service Pension

- Carer Payment,

- Disability Support Pension,

- Newstart,

- Parenting Payment Single, and

- DVA War Widow(er)s Pension, Income Support Supplement, and disability payments.

COMMONWEALTH HOME SUPPORT PROGRAMME FUNDING AGREEMENTS

The Government will provide $5.9 billion over two years from 2020-21 to extend the Commonwealth Home Support Programme (CHSP) funding arrangements. The CHSP contributes to essential home support services, such as meals (Meals on Wheels), personal care, nursing, domestic assistance, home maintenance, and community transport, to assist older people to keep living independently in their own home.

HEALTHY AGEING & HIGH QUALITY CARE

The Government will implement new policies to support people to stay at home longer, remain healthy and independent for longer, and to improve access to high quality, safe aged care.

Better Access to Care:

- An additional 10,000 new high level home care packages over five years from 2018-19

- 13,500 residential aged care places with $60 million investment in infrastructure

- $320m general subsidy for residential aged care

- An increase to the dementia and the veterans’ home care supplements to support home care recipients requiring additional care to stay in their homes longer

- Establishing the independent Aged Care Quality and Safety Commission from 1 January 2019.

- A National Plan to Respond to the Abuse of Older Australians, including $18m to create a new National Hotline (1800 ELDER Help or 1800 353 374) and conduct trials of frontline services for victims of abuse.

Better Quality of Care:

- $38.4 million over five years from 2018-19 to strengthen aged care regulation through the establishment of a risk-based compliance and information sharing system in the Aged Care Quality and Safety Commission;

- Introduce mandatory reporting against national residential care quality indicators for pressure sores, use of physical restraint, weight loss, falls and fractures, and medication management;

- Develop an end-to-end compliance framework for the Home Care program, including the increased auditing and monitoring of home care providers;

- Commence the implementation of an enhanced home care compliance framework to improve the quality and safety of home care services and enhance the integrity of the home care system;

- From 2019-20, resource the Aged Care Quality and Safety Commission to address the use of chemical restraints and the inappropriate use of antibiotics in residential aged care facilities;

- Provide additional support for the implementation of the Aged Care Workforce Strategy; and

- Undertake preparatory work for the introduction of a new Serious Incident Response Scheme from July 2022, which will require residential care providers to report a broader range of incidents occurring in their facilities.

Source: Australian Unity Personal Financial Services – CLICK HERE to download the PDF

Disclaimer: The information provided is current as at 5 April 2019 and is subject to change. This article is not personal financial, taxation or legal advice and should not be relied on as such. Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. You should obtain specialist financial, taxation or legal advice relevant to your circumstances before making investment decisions. Whilst every care has been taken in the preparation of this information, Australian Unity Personal Financial Services Ltd (‘AUPFS’) does not guarantee the accuracy or completeness of it. Where an article is provided by a third party any views in that article are the views of the author and not of AUPFS. AUPFS does not guarantee any particular outcome or future performance. Australian Unity Personal Financial Services Ltd ABN 26 098 725 145, AFSL & Australian Credit Licence No. 234459. This document produced in April 2019. ©