Market Update

Over the last week, the rapid spread of Coronavirus has impacted our lives in ways that were unimagined not so long ago. We just have to look at supermarket shelves being empty of essential items and the locking down of international borders for clear examples.

The impact to the global economy is also significant. Company’s earnings will be impacted due to the changing supply and demand dynamics, which will, in turn, see the unemployment rate increase. This will place further pressure on the global economy that is still relatively fragile post the GFC slowdown.

Central banks globally are adopting a “whatever it takes” approach to reduce the risk of a prolonged downturn by quickly cutting interest rates and stimulating economies via quantitative easing.

Asset markets have corrected in response to uncertainty regarding the consequences of the coronavirus outbreak. A slowing global economy and its impact in reducing company profits is driving share prices lower.

The important point

There is no doubt that we are in uncertain times and when markets move away from trading on their fundamentals it can present us with some good opportunities.

With investor anxiety being at high levels a disciplined, well-reasoned approach to investment is paramount in positioning investment portfolios to “weather the storm”. To this end, we remain vigilant in assessing opportunities and adjusting portfolios accordingly. Importantly, we are not trying to pick the bottom of markets but using our longer term, valuation-focused approach to best position portfolios.

We are committed to partner with our clients in ensuring good long-term outcomes. If we look at past global sell offs and then the post recovery periods, it’s the not taking part on the other side that can erode capital.

Some Key Reasons outlining current market movements

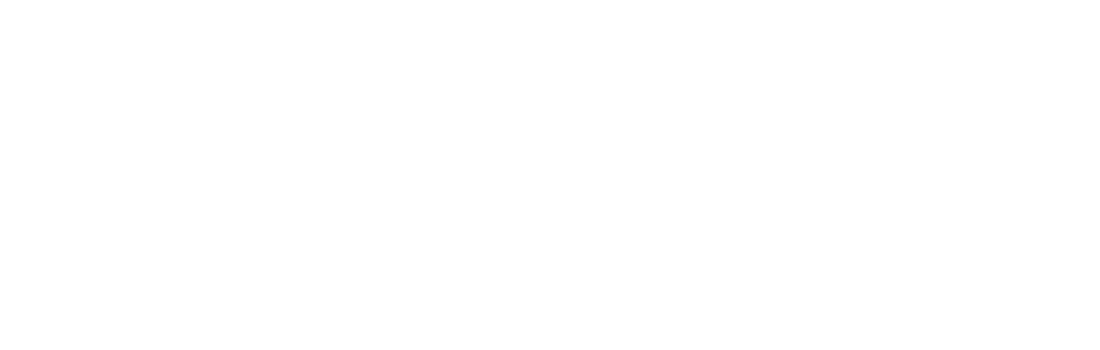

The chart below shows just how quickly the US market, measured by the S&P500 index, reacted to the reality of a global CORVID-19 pandemic, the fastest correction on record, hence why it feels bad.

Source: Deutsche Bank

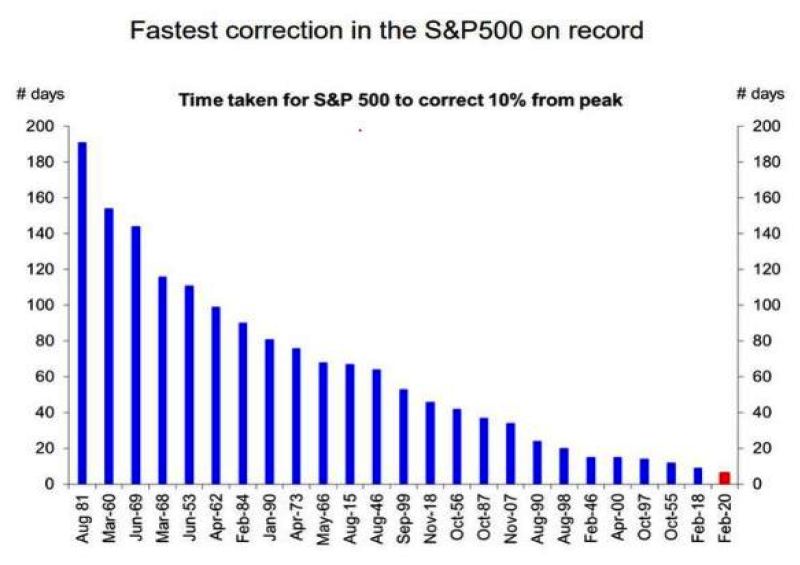

Source: Factset, Vertium.

Source: Factset, Vertium.

As the above chart shows in the last 30 years we have been through eight global slowdown periods, with this being the ninth, it important to remember that these events do occur and to get back to the previous peak can be as short as five months or as long as 125 months.

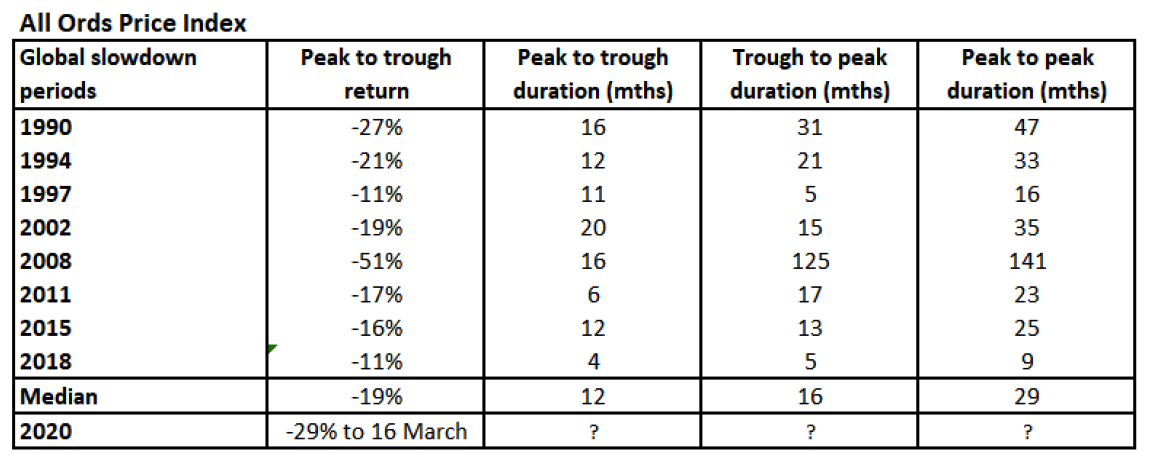

The chart below highlights how volatile equity markets have been recently i.e. the market is suggesting that in two months’ time share price could be up 70% or down 70% clearly, it’s not rational. Investors become increasingly irrational in times of stress and panic hence why equity prices are down 5-10% one day and then the next day up 5-10%.

Fixed Income markets have not been immune either, reiterating the point that no-one saw the extent of the impact CORVID-19 could have had on the global economy.

Government Bonds, a traditional safe-haven in market corrections, have actually been sold rather than bought as asset managers need liquidity i.e. cash, and also due to the fact that maybe government debt may not be as safe as it once was with ballooning central bank balance sheets. Corporate bonds have been repriced as the potential for company default increases.

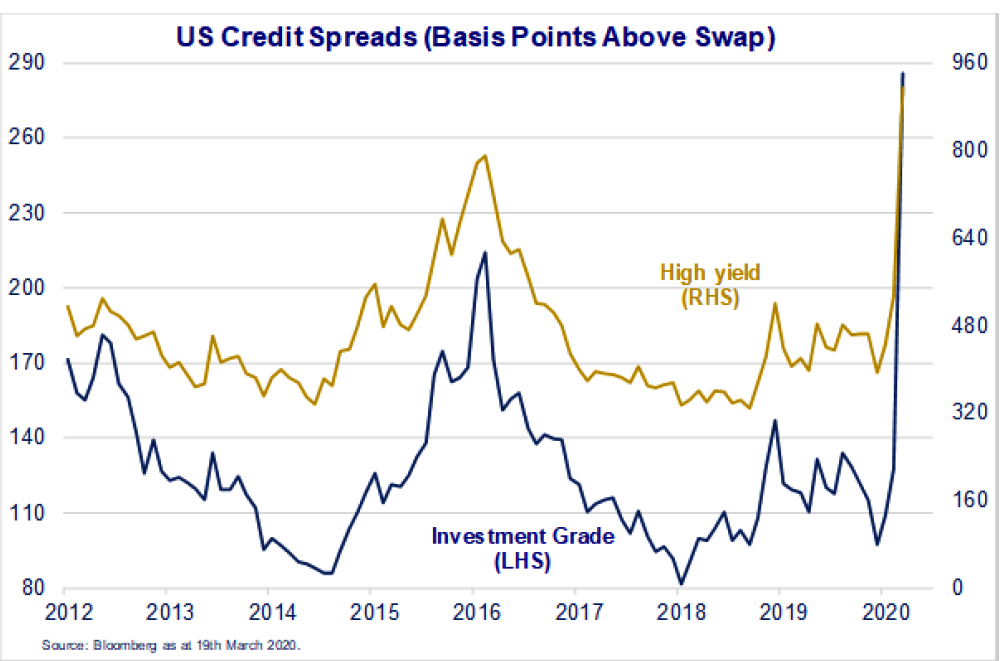

The chart below shows how yields on both investment grade and non-investment grade (high yield) bonds have risen as investors now demand a higher income return to offset the perceived elevated risk of corporate default.

For example, to buy a high yield bond in 2019 you would receive a payment of 4.8% or 480 basis points (bps) above a reference rate i.e. the cash rate, whereas if you bought that same bond today you are being paid 9.6% or 960 bps over the cash rate i.e. double the payment from 2019 due to the dislocation in markets. For those investors who bought the high yield bond in 2019 this would equate to a capital loss.

Article source: Australian Unity

Disclaimer: This Blog post is a publication of Australian Unity Personal Financial Services Limited ABN 26 098 725 145 (AUPFS), AFSL 234459. Its contents are current to the date of publication only, and whilst all care has been taken in its preparation, AUPFS accepts no liability for errors or omissions. This report is general in nature and does not take into account the objectives or circumstances of any particular individual or entity. It cannot be relied upon as a substitute for personal financial, taxation or legal advice. The information transmitted is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this in error, please contact the sender and permanently delete the material from your computer system. We cannot guarantee that this e-mail is virus-free. You should scan attachments with the latest virus scan before opening. We will not be liable for any loss, cost or damage of any kind whatsoever caused by any receipt or use of this e-mail and attachments. This document produced in March 2020. © Copyright 2020