Economic & Market Update September 2021

ECONOMIC UPDATE

Central banks and governments globally, are supportive of economic growth over the next 18 months as we all work towards a “COVID normal”. Employment data has been resilient, but wage growth has been stagnant. Unfortunately, wage growth is needed to kick start the economic recovery. Central banks are downplaying inflation pressures believing they will only be temporary, but at the same time they are preparing investors for when monetary policy will tighten.

In addition to the threat of inflation, COVID-19 and its associated variants continue to impede economic development. Even though the global vaccine roll-out has assisted in opening-up many regions, the new strains of the virus have demonstrated an ability to spread faster and continue to impede a full easing of border restrictions. This threat to economic recovery may be amplified as the northern hemisphere moves closer to winter.

The combination of stimulatory monetary policy from central banks combined with fiscal stimulus from governments has created a positive backdrop for asset prices over the past year. We have seen strong returns from growth assets such as equities and property. With cash rates close to zero in many parts of the world, investors have been encouraged to take risks in investment markets and, overall, have been rewarded.

EQUITY MARKETS

With most equity markets hitting all-time highs in July 2021 and producing returns of around 30% over the year to 31st July, the question that need answering is, why has this occurred and will it continue for the next 12 months and beyond?

Equities should return a risk premium over cash. Historically this premium has been around 5%. Equities should also have a volatility associated with them of around 15%, meaning in any year they could move up or down by 15%. When markets fell in March 2020, due to the COVID-19 pandemic, the one-month return was 21% for Australian equities. In the 16 months since, the Australian equity market has posted 15 positive months of returns.

The strong returns over the last 12 months have been driven by excess amounts of capital chasing, a defined pool of assets, and emboldened investors believing governments and central banks will do whatever it takes to stimulate economies and provide adequate liquidity to the financial system. Central bank policies aimed to flood markets with capital via initiatives such as quantitative easing and setting official interest rates at low levels have seen interest rates on cash and yields on bonds reduce significantly.

Assets such as property and equities have been viewed more favourably, relative to low yielding cash in the bank or fixed income. This has resulted in a willingness by investors to pay more for equities and has driven up share prices at a rate greater than the growth in company earnings.

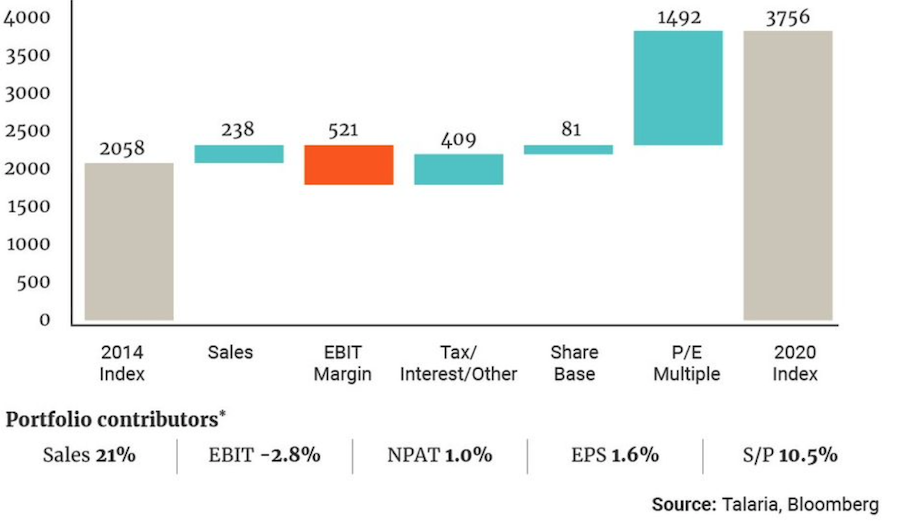

Chart 1. shows of the total return in the US Equity Market (S&P500) 10.5% p.a. is from share price expansion and only 1.6% from earnings per share increasing (financial years 2014 to 2020).

Note: the S&P500 has added 17% since this chart was published and is now at 4,400 index points.

For equity markets to continue their seemingly unabated surge, we need to see companies deliver earnings per share growth and justify higher valuations. There is scope however, for a pull-back in share prices to more adequately reflect uncertainty of future earnings growth.

THE OUTCOME

Investors face a paradox. A weaker rate of economic growth than anticipated post COVID-19 could lead to lower interest rates for bank deposits and lower bond yields. This could justify investors paying even higher prices for equity earnings as they search harder for higher returns. This can last if investors remain confident in government and central bank responses to these circumstances.

The recovery in earnings across sectors of the economy will be disparate. Some parts of the economy such as travel, education and hospitality continue to be negatively impacted by current circumstances, whilst some online retailers, banks and mining companies have seen earnings surge. There will be winners and losers as the economy recovers and investor sentiment towards certain companies and sectors will change as well.

With the world in various states of lockdown and consumers unable to travel and consume goods and services to the same extent as pre COVID-19, you could expect to see some volatility to earnings and share prices. However, when investing in equities you need to have a longer-term time horizon and accept the volatility as this delicate balancing act continues.

Different sectors of the economy (and equity markets) will respond differently to the “new normal” and unintended consequences of aggressive policy changes by both governments and central banks are likely to be revealed as we move forward. Volatility in equity markets can be expected as investors move to change tact as circumstances change.

Article source: Australian Unity

Important Information: Research insights is a publication of Australian Unity Personal Financial Services Limited ABN 26 098 725 145 (AUPFS). Any advice in this article is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making product decisions. Where appropriate, seek professional advice from a financial adviser. Where a particular financial product is mentioned, you should consider the product disclosure statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Australian Unity Personal Financial Services LTD (AUPFS) and its related bodies corporate make no representation as to its accuracy or completeness.