Market Commentary September 2024

In September, the US Federal Reserve cut the US Fed Funds rate by 0.5% to 4.75-5.00%. US inflation appears to be under control with August data revealing US inflation at an annualised rate of 2.5% p.a. much lower than the 9% p.a. peak seen in 2022. US employment whilst resilient has softened, justifying a more accommodative monetary policy stance. The European Central Bank also cut rates in the month by 25bps to 3.50% following on from their previous 25bps cut in June due to falling inflation and slower economic growth.

The surprise cut and stimulus came from China towards the end of the month. China’s economic growth has been tepid since COVID-19 related shutdowns. The property market has been in a crisis, there’s low consumer confidence, discretionary spending has fallen, overseas investment has reduced and China’s GDP growth target for the year at 5% looks to be a challenge.

How did China stimulate? They reduced the amount of cash that Chinese banks must hold in reserve by 50bps, freeing up 1 trillion yuan (~A$140bn) of liquidity. China also reduced mortgage rates by an average of 50bps, reduced the downpayment required for second home purchases from 25% to 15% and they plan to issue 2 trillion yuan (~A$280bn) in special sovereign bonds to further invest in the economy. All of these actions saw Chinese equities rally (up over 20% in the month) alongside materials stocks that had been sold off aggressively on the recent Chinese economic weakness.

Unfortunately, in September the Middle East conflict escalated to much more extreme levels since the conflict started back in October 2023. With the Hezbollah leader having been killed, retaliation has been high with nuclear threats rising. At the same time the Russia-Ukrainian conflict continues and without the US acting as the “world’s police”, hope is needed that both these conflicts abate with minimal further loss of lives. Markets have shrugged off both of these conflicts. However, if they continue/escalate further then supply chain issues and higher inflation risk destabilising investment markets.

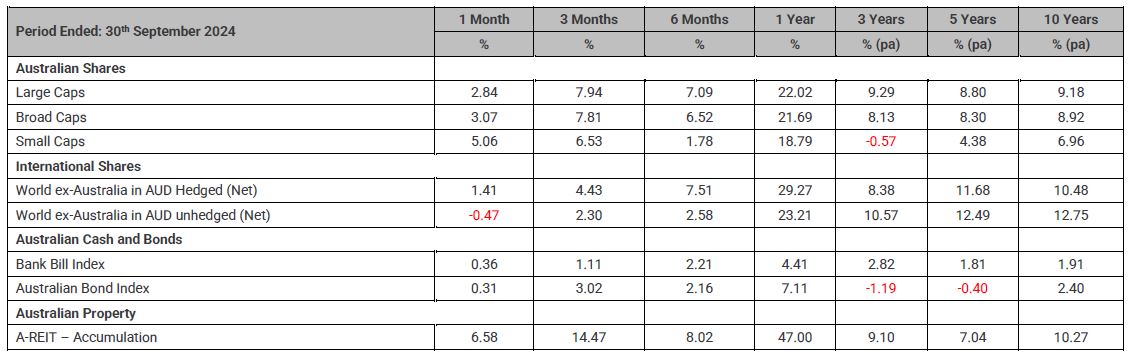

Australian large cap equities rose by 2.8% and in doing so closed at a new record high. The Materials sector was the strongest up 13% thanks to the Chinese central bank stimulus, Financials broadly flat and Healthcare falling the most in the month down 3.2%. Currency hedged global equities rose by +1.4% as the Australian dollar strengthened versus the US Dollar by 1.5 cents to close the month buying US$0.6913 and unhedged equities returned -0.5%

The Australian 10-year government bond yield rose by 3bps to 3.99% and the Australian 2-year government bond yield fell by 6bps to 3.62%. The US 10-year government bond yield fell by 12bps to close at 3.78% and the US 2-year government bond yield fell by 28bps to 3.64%.

Benchmark Returns

Article source: Personal Financial Services Ltd (PFS)

Disclaimer: Research Insights is a publication of Personal Financial Services Limited ABN 26 098 725 145 (PFS). Any advice in this article is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making product decisions. Where appropriate, seek professional advice from a financial adviser. Where a particular financial product is mentioned, you should consider the product disclosure statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Ltd (PFS) and its related bodies corporate make no representation as to its accuracy or completeness.