Market Commentary April 2025

The focal point for investment markets during April was US President Donald Trump’s announcement of tariffs on 2nd April. In the announcement he proposed a 10% tariff on essentially all imports, with steeper rates for major trading partners such as China (34% on top of existing 20% tariffs) and the European Union (20%). In addition, a 25% tariff on all foreign made cars and auto parts was announced in an effort to reset US trade deficits and re-invigorate US manufacturing. Later in the month President Trump suspended many of the announced tariffs for 90 days to allow time for negotiations and greater consideration.

In April the European Central Bank cut its deposit facility rate by 0.25% to 2.25%. In Australia the Reserve Bank of Australia left rates unchanged and the US Federal Reserve did not meet in April with a meeting scheduled for early May.

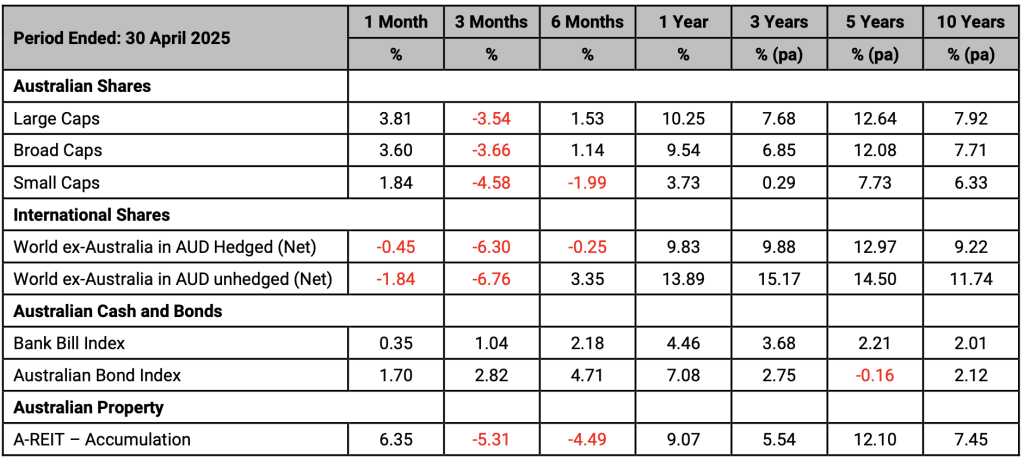

Australian large cap equities gained 3.81% in April, after being down as much as 7.81% during the month, led by the Communication Services sector (+6.72%), Information Technology sector (+6.37%) and the Consumer Discretionary sector (+6.12%). On the other hand, Energy (-7.72%) and Materials (+0.70%) were laggards as investor concerns regarding global economic growth due to tariffs weighed on these sectors.

Currency hedged global equities fell 5.04% for the month as the Australian dollar gained 2.48% versus the US dollar. At month’s end the Australian dollar closed at US$0.6402, up from US$0.6247 a month earlier. Unhedged global equities fell 1.84% for the month. US equities were down as much as 11.21% during the month before closing down 0.68%.

Bond yields in both Australia and the US moved lower during the month with the US 10 year bond yield falling 5bps to 4.16% and the US 2 year bond yield falling 28bps to 3.60%. In Australia, the Australian 2 year bond yield fell 41bps to 3.27% whilst the Australian 10 year bond yield fell 22bps to 4.16%. The price of gold increased by as much as 11.21% before closing the month up 5.29%.

Benchmark Returns

Article source: Personal Financial Services Ltd (PFS)

Disclaimer: Research Insights is a publication of Personal Financial Services Limited ABN 26 098 725 145 (PFS). Any advice in this article is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making product decisions. Where appropriate, seek professional advice from a financial adviser. Where a particular financial product is mentioned, you should consider the product disclosure statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Ltd (PFS) and its related bodies corporate make no representation as to its accuracy or completeness.