Market Commentary April 2021

April was another strong month for growth assets despite the increasing and alarming rise of COVID-19 cases in India with calls for a nationwide lockdown as cases surpass 20 million. In the US almost 150 million people have received at least one vaccine dose with the expectation that 70% of adults will be vaccinated by 4th of July.

Australian inflation came in rather subdued, increasing a below-consensus 0.6% in the quarter and 1.1% over the year. Transport costs made the largest contribution to the quarter’s increase, particularly automotive fuel which increased in price by 8.7%. The lower-than-expected inflation print, coupled with the US Federal Reserve’s dovish tone at its April board meeting, saw bond yields fall. All eyes will be on future inflation prints to see whether we see a structural shift higher in inflation or if accommodative monetary policy will be here ad infinitum as per Japan.

The US Federal Reserve Chairman, Jerome Powell, recently commented on investment markets stating that “Some of the asset prices are high. You are seeing things in the capital markets that are a bit frothy. That’s a fact. I won’t say it has nothing to do with monetary policy, but it also has a tremendous amount to do with vaccination and reopening of the economy”; effectively an acknowledgement of the impact that sustained very low interest rates are having on asset prices.

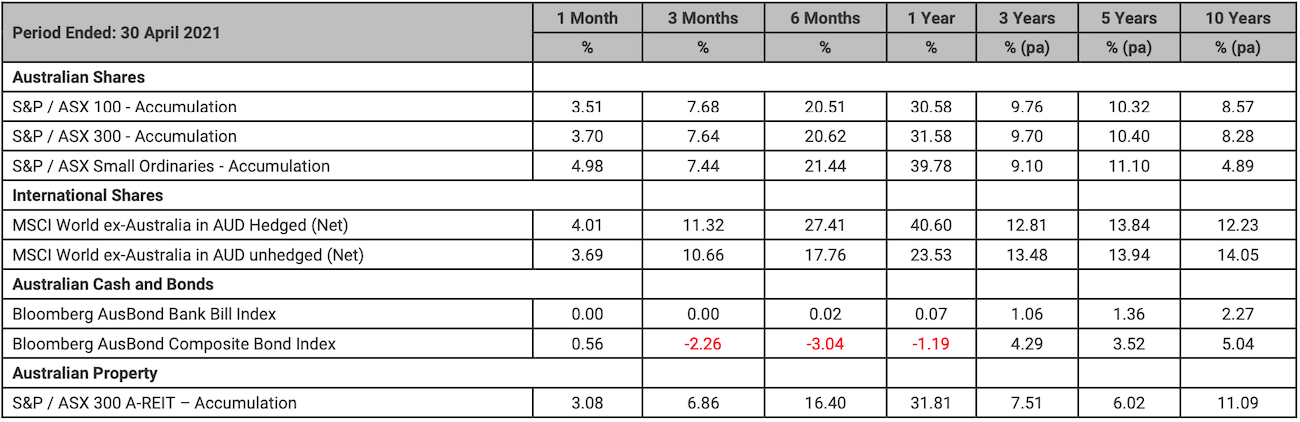

The Australian equity market was positive in April with the ASX100 up 3.5%. The Materials and Information Technology sectors outperformed, reversing their underperformance from March. The Materials sector was lifted with a surging iron ore price, up to ~US$185 per tonne which in turn has seen the Australian dollar strengthen by 1.3%. Small caps and listed property also performed well, delivering 5.0% and 3.0% respectively.

International equities rose by 4.0% on a currency-hedged basis while a slightly higher AUD (moving from US$0.7617 to US$0.7716) reduced returns slightly for unhedged investors to 3.7% for the month. US equities were again the standout with most large cap technology names reporting strong earnings and helping push markets to new all-time highs. Bucking this trend was Netflix, which fell after reporting a slow-down in subscriber growth – the company reported 36 million new subscribers during 2020 but now only forecasts 1 million new subscribers in the next quarter.

The yield on the Australian 10-year government bond yield fell 4bps to 1.75% and the 2-year government bond yield fell by 1bp to 0.08%. In the US the 10-year government bond fell by 11bps to close at 1.63% and the 2-year government bond yield was flat at 0.16%. Reflecting the fall in yields, fixed interest indices gained during the month.

Article source: Australian Unity

Important Information: Research insights is a publication of Australian Unity personal financial services limited ABN 26 098 725 145 (AUPFS). Any advice in this article is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making product decisions. Where appropriate, seek professional advice from a Financial Adviser. Where a particular financial product is mentioned, you should consider the product disclosure statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Australian Unity Personal Financial Services Ltd (AUPFS) and its related bodies corporate make no representation as to its accuracy or completeness.