Market Commentary April 2020

After equities entered a bear market in the March quarter with many equity indices down over 20%, in April we saw markets rebound strongly as central bank support coupled with the flatting/reduction of COVID-19 cases gave investors some much needed hope and confidence that the world could potentially return to “normality”.

However, not all was that rosy. Bank dividends have come under pressure with many banks cutting or deferring their dividends plus embarking on capital raisings to shore up their balance sheets as have many other companies/sectors. Many companies have removed earnings guidance ensuring that investors are not given any false hopes as the impact to company earnings and survival post COVID-19, whenever that may be, are still not fully known or understood.

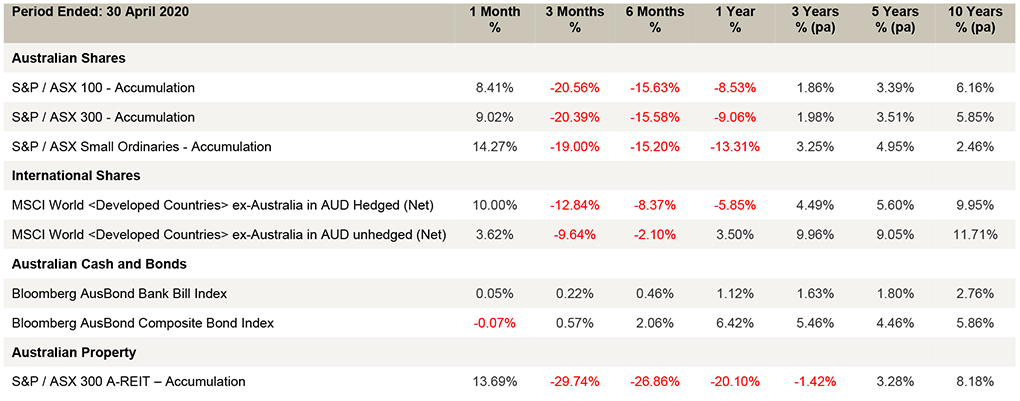

Despite the Australian market being awash with corporate actions and reduction in dividends, the ASX300 gained 9.02% for the month and the ASX Small Ordinaries rose by over 14%. Australian listed property that fell by 35% in March rose by 13.69%. Overseas indices were also up, unhedged international equities by 3.62%, whilst a higher AUD (up 6.2% against the USD to close at US$0.6514) helped hedged international equities return 10% in April.

In April 2020 the International Monetary Fund (IMF) revised downwards its projections for global economic growth for 2020 from 3.3% to -3.0%. However, the IMF strongly revised upwards its projections for global economic growth in 2021 from 3.4% to 5.8%. The IMF qualified its forecasts with the following: “There is extreme uncertainty around the global growth forecast. The economic fallout depends on factors that interact in ways that are hard to predict, including the pathway of the pandemic, the intensity and efficacy of containment efforts, the extent of supply disruptions, the repercussions of the dramatic tightening in global financial market conditions, shifts in spending patterns, behavioural changes (such as people avoiding shopping malls and public transportation), confidence effects and volatile commodity prices.” 1

With the short-term outlook for global economies not looking that great, the medium-term outlook is more positive and due to the flood of central bank liquidity we saw a steepening of yield curves in April particularly in Australia. The Australian 10-year government bond yield rose by 13 bps to 0.89% p.a. whilst the 2-year bond yield fell by 3 bps to 0.22% p.a. The US 10-year government bond yield fell by 3bps to 0.64% p.a. and the US 2-year bond yield fell by 5 bps to 0.20% p.a.

Benchmark Returns 30 April 2020

1 Based on foreign tax rates 2019-20 and assuming there’s no other taxable income.

1 Based on foreign tax rates 2019-20 and assuming there’s no other taxable income.

Article source: Australian Unity

Important Information: This article is a publication of Australian Unity Personal Financial Services Limited ABN 26 098 725 145 (AUPFS), AFSL 234459. Its contents are current to the date of publication only, and whilst all care has been taken in its preparation, AUPFS accepts no liability for errors or omissions. The application of its contents of specific situations (including case studies and projections) will depend upon each particular circumstance. This publication is general in nature and has been prepared without taking into account the objectives or circumstances of any particular individual or entity. It cannot be relied upon as a substitute for personal financial, taxation, or legal advice. This article was produced on 01 May 2020. © Copyright 2020