Financial Insights August 2022

Revisiting the ‘Retirement’ condition of release

Where an individual satisfies a condition of release, their superannuation can be accessed as lump sums and/or rolled over to commence a retirement phase pension where earnings and gains on assets will be tax free.

Depending on client circumstances, satisfying the retirement condition of release appears to be a simple process however there are considerations should be aware of. In this article, we unpack the technicalities of the retirement condition of release and answer some common questions.

CONSEQUENCES OF GETTING IT WRONG

Where the facts of the case indicate there has been no satisfaction of the retirement condition of release or that an individual has entered into a scheme to facilitate meeting the retirement condition, the Australian Taxation Office (ATO) could seek to apply the anti-avoidance provisions in the Tax Act where an individual has obtained a tax benefit by converting benefits in the taxable accumulation phase to the tax free retirement phase.

Penalties can also apply for the breach of the Superannuation Industry (Supervision) Act 1993 (SIS Act) including the preservation rules and sole purpose test.

This considered approach aligns with standard one of the Code of Ethics which requires advisers to not only comply with the letter of the law in meeting their legal obligations, but also to comply with the intent of those laws and not seek to avoid or circumvent them.

THE RETIREMENT DEFINITION

The definitions of retirement (1) and cessation of gainful employment (2) are pivotal to whether someone has met a condition of release in Part 6 and Schedule 1 of the Superannuation Industry (Supervision) Regulations 1994 (SIS Regs). Based on a persons age, the retirement definition is split into two phases.

Client is between preservation age and age 60

If an individual has reached preservation age and is younger than 60, retirement occurs when they have ceased gainful employment and the trustee is reasonably satisfied the individual intends at that time never again to be gainfully employed on a full-time or part-time basis3. A person is not prohibited from subsequently returning to gainful employment in the future, provided he or she does not have the intention to return to work for more than 10 hours per week when declaring their retirement.

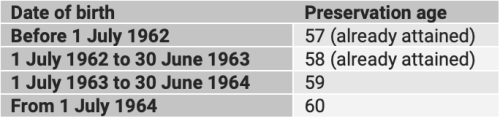

Preservation age

Once 60 or older, retirement is where gainful employment has come to an end and they were at least 60 when that employment ceased. There is a second arm to the post-60 retirement definition in paragraph (b)(ii), which operates where gainful employment has come to an end, presumably prior to age 60, and the trustee is reasonably satisfied that they intend never again to become gainfully employed, either on a full-time or a part-time basis. To meet this requirement, both APRA and the ATO have confirmed (4) that there are no superannuation law requirements governing how recently the employment arrangement cessation must have

occurred.

In most cases, an individual will meet the requirement that they ceased at least one means of gainful employment after reaching age 60 and be considered retired. There is no requirement that all gainful employment cease, as it is sufficient to cease just one employment arrangement after reaching age 60 to meet the retirement definition.

Upon attaining age 65 super becomes accessible as it is a condition of release that is automatically applied.

WHEN IS A CLIENT GAINFULLY EMPLOYED?

The SIS Regs stipulate that a client is gainfully employed for superannuation purposes where they are employed or self-employed for gain or reward in any business, trade, profession, vocation, calling, occupation, or employment.

Gainful employment can either be on a part-time (at least 10 hours per week and less than 30 hours per week) or full-time basis (at least 30 hours per week).

The definition of gainful employment contains two limbs:

- Employment or self-employment, and

- Gain or reward.

The term employee is not specifically defined in the SIS Act for this purpose so its common law meaning must be considered. One definition of employee is:

‘in a service of another under any contract of hire (whether the contract was expressed or implied, oral or written), where the employer has the power or right to control and direct the employee in the material details of how the work is to be performed.’

In contrast, self-employed people work for themselves running their own business e.g., have a business plan, financial records, an ABN, a regular and frequent level of activity in the business, advertising etc.

The superannuation legislation does not define the meaning of ‘running a business’. However, taxation law does. In particular, paragraph 13 of Tax ruling 97/11 outlines relevant indicators.

Gain or reward is not defined in the superannuation legislation and therefore takes its ordinary meaning. The Macquarie Dictionary defines gain as ‘to get an increase, addition or profit’. Reward is defined as ‘something given or received in return for service, merit, hardship, etc’.

In the context of satisfying the gainful employment definition, it follows that the service, merit, or hardship must be completed with some expectation of an increase, addition, or profit. There must be a direct link (or nexus) between the activity undertaken and the reward provided for the activity. The actual level or amount of gain or reward does not necessarily have to be commensurate with the level of effort or activity undertaken. The reward doesn’t necessarily have to be received as cash, but could be received as services, fringe benefits, or other valuable consideration.

The gain or reward element is unable to be satisfied in the case of charity or volunteer work. Non-paid work for a charity, for example, does not qualify as gainful employment. Also, reimbursement of expenses generally does not constitute gain or reward.

A common question is whether being the director of a corporate entity considered gainful employment? The answer to this is it’ll depend on whether the director is entitled to payment for the performance of their duties. The director of a company is not generally considered to be an employee under the common law however section 15A of the SIS Act expands the meaning of employee for superannuation purposes to include company directors who are entitled to payment for the performance of their duties.

Under corporations law (5), a director is not entitled to be paid for their services unless it’s specifically permitted under the company’s constitution or it has been approved in a shareholder resolution. Therefore, if there is adequate record and documentation evidencing that a director of a private company was remunerated for performing their duties as being a director then they are considered an employee of the company.

Care needs to be taken as sometime an individual may be employed as both an employee of the company and a director, in which case there need to be clear evidence that at least some of the remuneration paid is for the performance of their directorship duty.

EVIDENCING CESSATION OF GAINFUL EMPLOYMENT

Genuine terminations of employment typically involve the payment of accrued benefits, such as annual and long service leave. Trustees can request written evidence of a persons cessation of gainful employment and SMSF trustees should detail this written evidence on file and send a copy to the administrator, so the fund auditor has access.

For the self-employed, terminating gainful employment is generally evidenced by a closure of the business and cessation of business activity e.g. business assets or stock is sold or disposed of, outstanding bills have been paid, ending of lease agreements, lodgement of final tax returns and cancellation of their Australian Business Number.

ATO SCRUTINY

When determining whether gainful employment has ceased, the ATO have stated that even if an individual ceases to be gainfully employed through a controlled trust or company, it may put into question whether a client has met the retirement definition if they continue to perform substantive duties and is remunerated through passive mechanisms such as distributions or dividends.

In the detailed case study analysis provided by the ATO, Charlie was an employee of Crackle (a smash repairs business carried on by the Crackle Discretionary Trust of which Charlie was also a beneficiary). He formally terminated his employment contract however continued to perform substantive duties for Crackle (much the same as when he was an employee) and continued to receive trust distributions also.

The ATO determined that based on facts presented in the case study, Charlie did not clearly satisfy the retirement condition of release despite having terminated his employment contract.

COMMON QUESTIONS

If a person satisfies the retirement definition after age 60, when utilising a recontribution strategy, will the amounts contributed to super remain unrestricted non-reserved?

Contributions made to super remain preserved until a condition of release is met for under 65 years of age. Depending on the person’s situation, if the individual is not working and remains “retired” they can make a new retirement declaration. If they have since returned to the workforce, they can terminate another employment arrangement. Alternatively, they can wait until they attain age 65 when super automatically becomes accessible.

Does an individual need to have worked in their lifetime to declare retirement?

To be retired, an individual must have ceased a gainful employment arrangement at some point in their life, even if it happened prior to the person reaching their preservation age. If an individual has never worked e.g., they were the primary carer for their children and was never gainfully employed in their lifetime to date – they are incapable of declaring retirement. This means that unless any other condition of release applies, this individual can only access their super at age 65.

If an individual is changing from full time to part time employment after turning age 60. Have they met the retirement definition?

If this is the only job ever worked in their lifetime, they will not satisfy the retirement definition. This is because they have not terminated an employment arrangement after age 60 and have instead varied their working hours.

If they’ve worked another job anytime in their lifetime however, we can look to the second arm of the post-60 retirement definition in paragraph (b)(ii), which operates where gainful employment has come to an end, presumably prior to age 60, and the trustee is reasonably satisfied that they intend never again to become gainfully employed, either on a full-time or a part-time basis.

Meaning, if the individual has terminated an employment arrangement at any other point in their lifetime, by reducing their working hours to part time i.e. 10 hours or less per week., they satisfy the retirement definition.

An individual should retain evidence that they were previously gainfully employed to evidence they satisfy this condition of release e.g. copies of old payslips, tax returns (that show employment income), a termination letter from their employer or copies of old employment contracts.

1. SIS regulation 6.01(7).

2. SIS regulation 1.03(1).

3. Part time and full time are defined in SIS regulation 1.03.

4. Paragraph 66 of APRA former Superannuation Circular I.C.2 (September 2006). While the Circular is no longer current, there is no indication that APRA’s view has changed since that time. ATO Guidance Note GN 2019/1.

5. s202A or s202C of the Corporation Act 2001

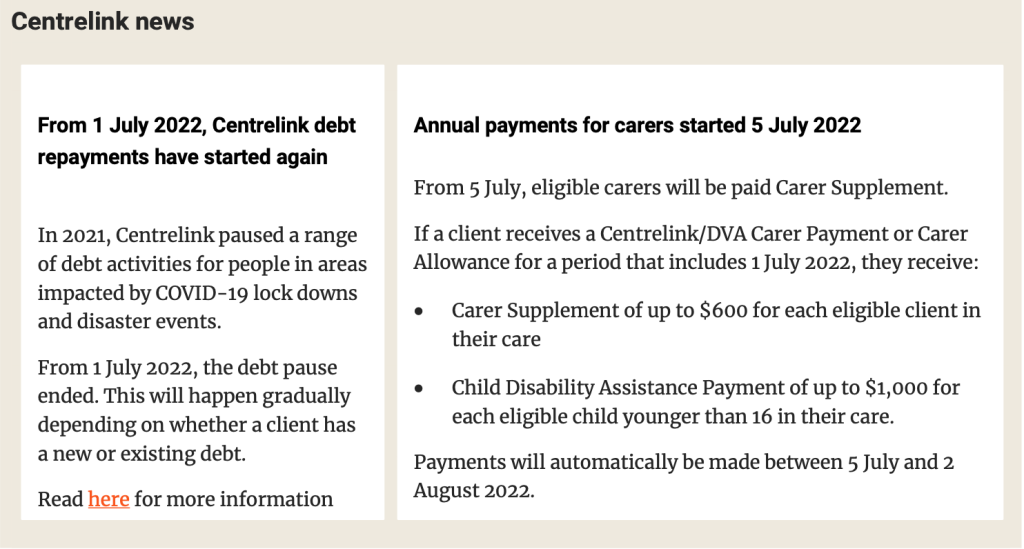

Regulatory update

NO PROGRESS ON CSHC INCOME TEST CHANGES SO FAR

As part of its election push, the ALP stated their intention to amend the income test for the Commonwealth Seniors Health Card increasing it to $90,000 a year for singles (up from $57,761) and to $144,000 a year for couples (up from $92,416) from 1 July 2022.

The Bill implementing this change has so far not progressed.

A COMMITMENT TO FREEZE DEEMING RATES FOR TWO YEARS

Minister for Social Services, the Hon Amanda Rishworth MP, has announced the Australian Government is committed to freezing social security deeming rates at their current levels for a further two years.

The freeze applies to all people receiving social security payments.

The lower deeming rate will remain frozen at 0.25 per cent and the upper rate will remain at 2.25 per cent for the next two years to 30 June 2024.

From 1 July 2022, the lower deeming rate applies to financial investments up to the threshold amounts of $56,400 for singles and $93,600 for couples.

The upper deeming rate applies for financial assets above these thresholds.

The Government indexes deeming rate thresholds every 1 July, in line with increases in the cost of living.

SMSF REPORTING NIL CLIENT ACCOUNT BALANCES TO THE ATO

Recent ATO guidance has been published relating to nil member account balances. In some cases a nil account balance may indicate the SMSF has not been administered correctly especially if:

- the fund has only one member, or

- there are no contributions, rollovers or transfers recorded for a member over several years.

The ATO has advised that if a member of an SMSF is showing a nil account balance, trustees should make sure:

- the fund has been set up correctly

- the member intends to contribute to the fund in the future

- trustees are complying with the super and tax laws.

Even where there are genuine reasons for a nil account balance, a member who is also a trustee (or director of a corporate trustee) of the SMSF is still responsible for running the fund and making sure the super and tax laws are complied with.

The following situations may lead to a nil account balance:

- Illegally accessed early release of super

- Newly established funds x Fund not structured correctly

- Limited recourse borrowing arrangements

Nil account balances need to be reported a certain way when lodging the SMSF annual return.

A NEW LOOK AT CONTRIBUTION CAPS

The ATO has announced that members can now view more information and manage their contributions using ATO online services (accessed via myGov). Currently, clients can view their concessional contributions cap and unused concessional contributions.

Non-concessional contribution details have been added:

- the remaining cap amount for the financial year

- whether the member is close to exceeding the cap for the financial year

- if the member has exceeded the cap, it shows the amount by using clear labels and coloured indicators.

Both contribution types have been enhanced to include coloured indicators and clear labels such as ‘eligible’ or ‘not eligible’, so members can easily view and manage their information.

DOWNLOAD A PDF VERSION OF THIS UPDATE HERE.

Article source: Australian Unity

Disclaimer: Disclaimer: The information provided is current as at 27 July 2022 and is subject to change. This article is not personal financial, taxation or legal advice and should not be relied on as such. Any advice in this document is general advice only and does not consider the objectives, financial situation or needs of any person. Tax rates and thresholds are valid for 2022-23 financial year. You should obtain specialist financial, taxation or legal advice relevant to your circumstances before making investment decisions. Whilst every care has been taken in the preparation of this information, Australian Unity Personal Financial Services Ltd (‘AUPFS’) does not guarantee the accuracy or completeness of it. Where an article is provided by a third party any views in that article are the views of the author and not of AUPFS. AUPFS does not guarantee any outcome or future performance. Australian Unity Personal Financial Services Ltd ABN 26 098 725 145, AFSL No. 234459. This document produced in July 2022. ©