Financial advisers save investors from poor decisions during COVID market mayhem

Financial advisers counselling a disciplined approach to investing over the past year helped Australians avoid a litany of poor investment calls during tumultuous market conditions – adding an estimated more than 5.2% p.a. in value to their clients’ portfolios.

The results form part of Russell Investments fourth-annual Value of an Adviser Report released today, which attempts to quantify the value financial advisers can provide throughout their clients’ investing journeys. The 2021 Report analyses market movements and investor behaviour from the beginning of the pandemic and through the market’s stunning recovery to mid-2021, highlighting a range of investor pitfalls including trying to time markets, loss aversion, overconfidence, and leaving cash on the sidelines.

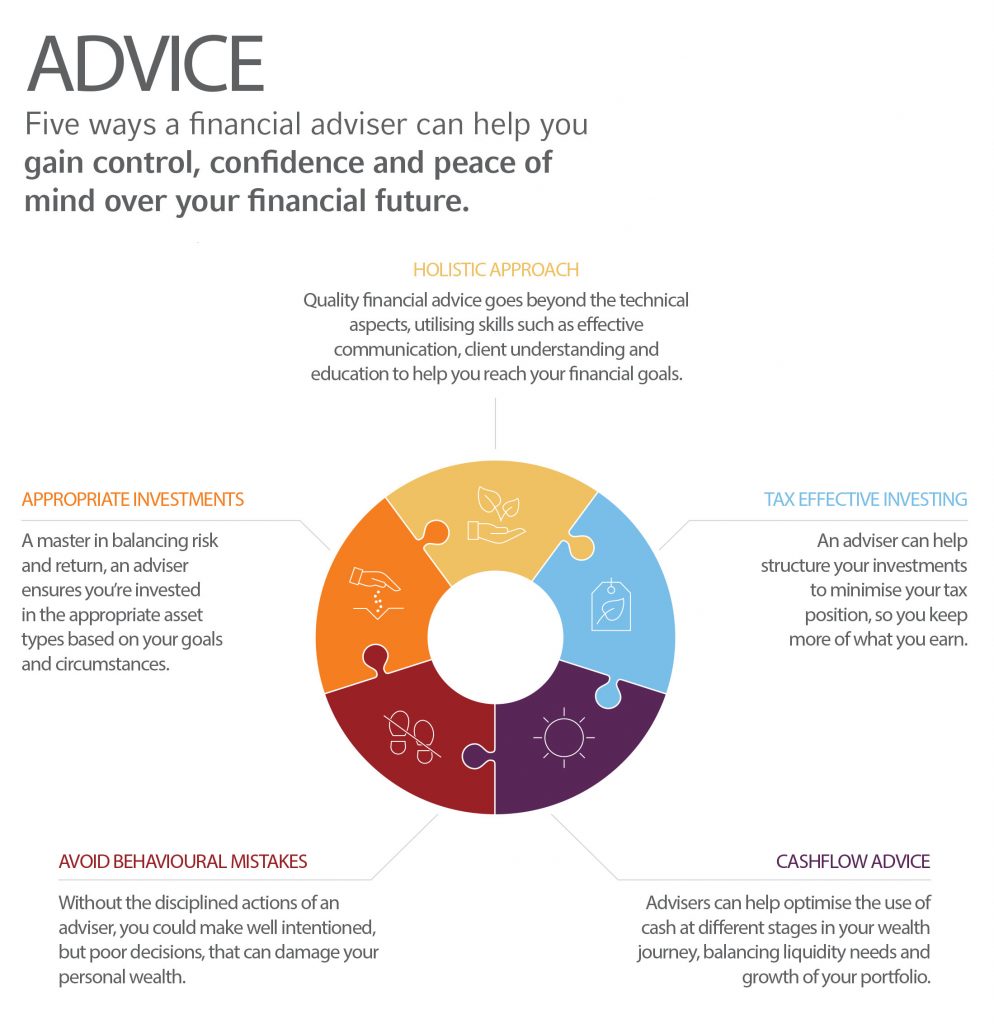

The value of an adviser calculation is drawn from five key elements: preventing behavioural mistakes (2%); advising on appropriate asset allocation (1.1%); optimising cash holdings (0.6%); tax-effective investing and planning (1.5%); and the priceless value of expert wealth management knowledge derived from years of market experience.

Throughout the COVID-induced market dislocation and recovery, the most critical mistake nonadvised investors made was to abandon their long-term investment strategies and sell out of equities after dramatic market falls – missing out on investment gains as the market roared back to life.

In the superannuation environment, it’s estimated around 1.5% (~$40.5 billion) of the system’s total funds under management were switched into cash by members spooked by the market’s reaction to the pandemic[1].

The Report shows that the beneficial impact for an investor who started 2020 with a portfolio worth $250,000 and stayed in the market until 31 May this year – rather than switching to cash when markets were volatile in March 2020 or flat in March 2021 – was as large as $40,000.

Russell Investments’ Director, Head of Business Solutions, Bronwyn Yates said the events of the past year underlined the critical role advisers play in not only in growing their clients’ wealth, but in helping them to avoid the hazards which confronted investors as the crisis engulfed markets.

“Investors who have been educated by a financial adviser understand there will be ups and downs along their financial journey, so they feel comfortable in staying the course,” Ms Yates said.

“However, non-advised investors sometimes fail to make the correct decision when markets are volatile, and often incorrectly time their exit and subsequent re-entry to the market. This is an issue which plagues both those with loss aversion, and those convinced they can beat the market. It’s also a timely consideration for the growing ranks of millennials and Gen Z turning to ‘finfluencers’ as their source for financial advice.

Russell Investments’ research demonstrates that behavioural coaching contributes 2% p.a. in value to portfolios by steering clients away from loss aversion mistakes and poor investment decisions underpinned by overconfidence.

“The value of advisers has never been more obvious than during the past year and is particularly apparent now as many Australians use their time in lockdown to renew their interest in investment markets. While it’s positive that investors across generations are becoming more engaged with their finances, and that they have more guidance options than ever before, the value of professional advice clearly speaks for itself in our report findings,” Ms Yates said.

APPLYING THE RIGHT ASSET MIX

Beyond assisting clients to avoid common pitfalls, the Value of an Adviser Report outlines the important role advisers play in ensuring clients invest in an appropriate mix of asset classes.

Research shows that up to 85% of an individual’s investment outcome is derived from their asset allocation[2]. Additionally, the report shows that the value of appropriate asset allocation is worth 1.1% to client portfolios.

However, many investors are either not interested in or lack the knowledge required to design and implement an asset allocation mix to suit their particular circumstances.

“While some investors are enthusiastic about their capabilities, many lack the skills, knowledge and time to research the many investment options available to them. Often, non-advised investors are tempted to chase performance and overreact to market events, like the sudden periods of market volatility witnessed in recent times,” Ms Yates said.

“Where there is a knowledge gap, it often relates to investors not understanding the relationship between risk and return and how it can impact their investment strategy and ability to achieve their goals. For example, investors taking on too much risk at the wrong time of their investment horizon, or not taking enough risk can lead to significant shortfalls to their objective.”

VALUABLE SUPPORT FOR ADVISERS

Ms Yates said the report aims to provide advisers with a resource to help articulate and quantify the value they provide clients throughout the advice journey.

“The value of an adviser is far greater than just placing clients’ money into investment products and updating them on their progress. Beyond the material value of financial advice, the peace of mind and comfort that advisers provide clients is critical, and it is important for advisers to be able to clearly communicate those benefits,” Ms Yates said.

“With the cost of delivering advice increasing, this report is a critical tool which arms advisers with the information required to have confident client conversations on the value of their services.

“Advisers play a crucial role in the financial health of Australia, and we believe that they have never been more valuable than now.”

[1] Source: RBA Financial Stability Review April 2021, Box C: What did 2020 reveal about liquidity challenges facing superannuation funds?

[2] Russell Investments Making Super Personal Whitepaper 2020