Market Commentary May 2024

In May US inflation for the year to April was released with the annual rate of inflation falling to 3.4% (down from 3.5% the previous month) which is still much higher than the US Federal Reserve’s targeted 2% inflation rate. Despite the higher inflation print bond yields, or to put it another way, the expected future cash rates fell assisting US equity valuations.

Australian inflation data in April came in at an annualised rate of 3.6% which was slightly ahead of expectations. Also released in April by the Australian Bureau of Statistics was the unemployment rate which rose slightly in April to 4.1%. These data prints have led the market to believe that future cash rate expectations are an accurate assessment of risks and rewards to the Australian economy i.e. the RBA is unlikely to cut rates soon and bond yields were fairly static in the month.

Australian large cap equities rose by 1.0% led by the Information and Technology and Utilities sector. Further effervescence in Artificial Intelligence (AI) led by strong earnings reports helped lift US large cap technology names. The expectation that the European Central Bank (ECB) will cut rates led to European equities posting strong returns led by the financial and real estate sectors. Hedged global equities rose by 4.0% whilst unhedged global equities rose by 2.0%, the Australian dollar strengthened by 1.4% in April buying US$0.6653.

There was little change to Australian bond yields, the Australian 10-year government bond yield fell by 1bp to 4.41% whilst the Australian 2-year government bond yield rose by 2bps to 4.12%. The US 10-year government bond yield fell by 19bps to close at 4.50% and the US 2-year government bond yield fell by 18bps to 4.87%.

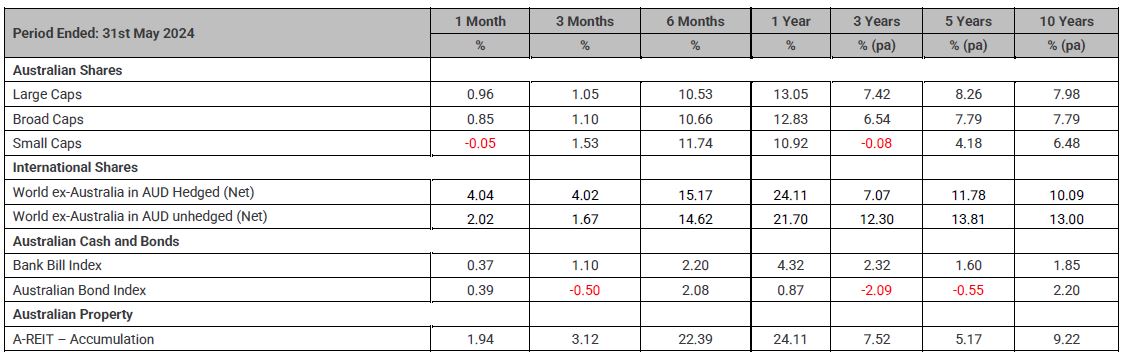

Benchmark Returns

Article source: Personal Financial Services Ltd (PFS)

Disclaimer: Research Insights is a publication of Personal Financial Services Limited ABN 26 098 725 145 (PFS). Any advice in this article is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making product decisions. Where appropriate, seek professional advice from a financial adviser. Where a particular financial product is mentioned, you should consider the product disclosure statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Ltd (PFS) and its related bodies corporate make no representation as to its accuracy or completeness.