Market Commentary May 2023

In May investment markets fretted over the US Government’s debt ceiling negotiations as Democrats and Republicans aimed to strike a deal that would suspend the debt-issuance cap for 2 years to avoid a default. Any default would have significant ramifications for the US dollar and the credit quality of US debt with impacts felt across asset classes.

The RBA surprised markets with a 25bps rate rise, taking the cash rate to 3.85% and driving the Westpac Consumer Sentiment index to a deeply pessimistic reading – down 7.9% to 79.0 (a reading of 100 is neither optimistic nor pessimistic). The US Federal Reserve and European Central Bank also raised policy rates during the month. In contrast to US inflation which cooled to 4.9% for the year to the end of April, Australian inflation rose 6.8% for the same period, up from 6.3% for the year to March, with housing, food and transport components the key drivers.

China’s economic expansion, as measured by the National Bureau of Statistics Purchasing Managers Index, contracted slightly in May following a sharp contraction in the prior month. Commodity prices fell as renewed optimism about Chinese economic growth began to wane.

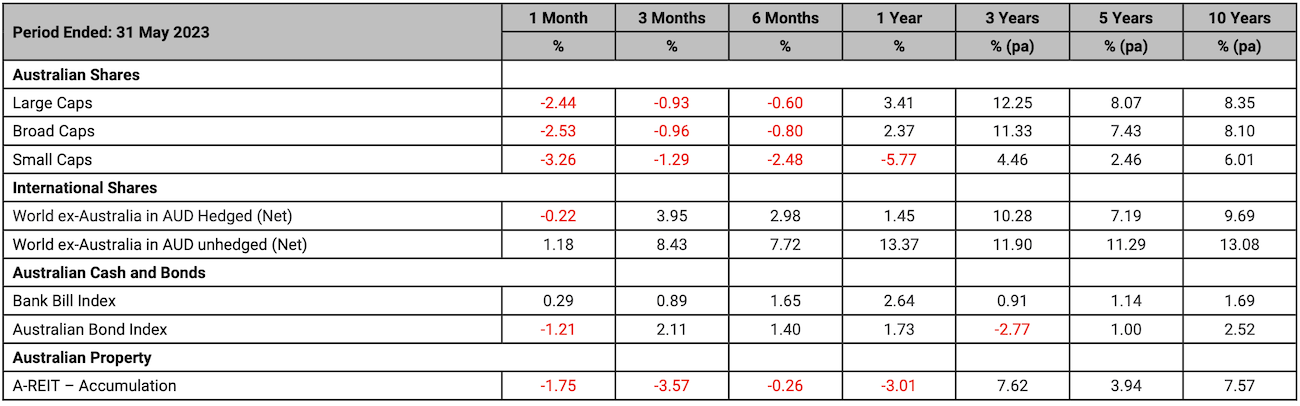

A surge of enthusiasm in companies linked to Artificial Intelligence (AI) saw the US technology-heavy NASDAQ stock market index gain 7.6% in May. Locally, the Australian share market declined (-2.4%) with Consumer Discretionary, Financials and Consumer Staples stocks impacted most. On the other hand, Information Technology stocks surged, benefiting from enthusiasm regarding AI developments. Currency-hedged international equities were down 0.2% and unhedged international equities gained 1.2% as the Australian dollar declined (-1.7%) against the US dollar, buying US$0.6503 at the close of the month.

The Australian 10-year government bond yield rose by 27bps to 3.61% and the 2-year government bond yield rose by 51bps to 3.55%. The US 10-year government bond yield rose by 22bps to close at 3.64% and the US 2-year government bond yield rose by 40bps to 4.40%.

KEY DEVELOPMENTS POST MONTH-END

Lawmakers in the US agreed to a debt ceiling deal in a bipartisan deal laden with compromise.

The RBA met on 6th June and elected to increase the cash rate by 0.25% to 4.10% noting that “this further increase in interest rates is to provide greater confidence that inflation will return to target within a reasonable timeframe.”

Benchmark Returns

Article source: Australian Unity

Disclaimer: Research Insights is a publication of Australian Unity Personal Financial Services Limited ABN 26 098 725 145 (AUPFS). Any advice in this article is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making product decisions. Where appropriate, seek professional advice from a financial adviser. Where a particular financial product is mentioned, you should consider the product disclosure statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Australian Unity Personal Financial Services Ltd (AUPFS) and its related bodies corporate make no representation as to its accuracy or completeness.