Market Commentary July 2020

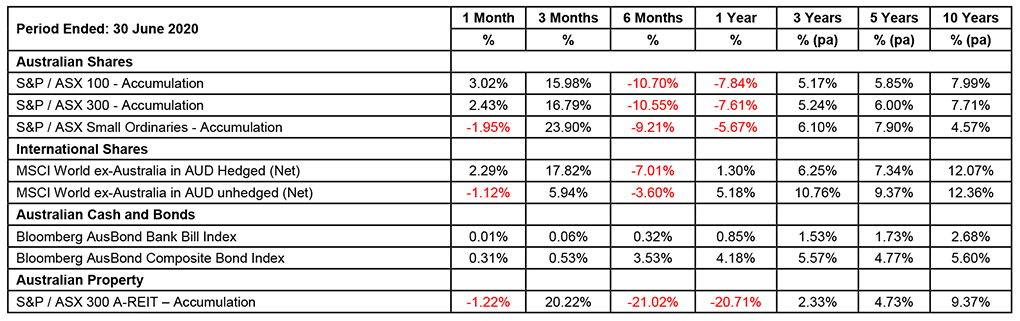

Growth asset returns were mixed in June with divergence between small cap and large cap stocks, hedged and unhedged equities and Australian listed property versus Australian large cap stocks. However, over the quarter, with the exception of unhedged international equities returning 6%, all other growth assets had an exceptional quarter and returned between 17% and 24%. Unfortunately, these large rebounds from the March lows still saw many growth assets post a negative return for the financial year.

During the month the International Monetary Fund (IMF) further downgraded their global growth forecast; the IMF now expects the world’s richest economies to contract by 8% in 2020 down 1.9% from their April forecasts and in 2021 the IMF expects these economies to grow by 4.8%. Due to the vast amount of central bank stimuli, the IMF expects public debt of advanced nations to reach 130% of GDP, during World War2 debt peaked at 120% of GDP. Of particular interest is the divergence in how asset prices have reacted. On the one hand, the Nasdaq (a US technology heavy stock exchange) reached a record high in June whilst the traditional safe haven asset of Gold, in US Dollar terms, surpassed it’s 2012 high to close the month at US$1,785/ounce.

The Australian equity market gained 3.02% for the month with consumer discretionary stocks and the financial sectors assisting whilst energy and industrials stocks were the two main detractors. The ASX Small Ordinaries fell by 1.95% for the month and Australian listed property also fell in June posting a return of -1.22%.

Yield curves remained fairly static in June, both the Australian 10-year and 2-year government bond yield fell by 2bps to end the month yielding 0.87% and 0.25% respectively. In the US yields rose by 1bps across both the US 10-year and 2-year government bond closing with a yield of 0.66% and 0.17% respectively.

Benchmark Returns 30 June 2020

Article source: Australian Unity

Important Information: This article is a publication of Australian Unity Personal Financial Services Limited ABN 26 098 725 145 (AUPFS), AFSL 234459. Its contents are current to the date of publication only, and whilst all care has been taken in its preparation, AUPFS accepts no liability for errors or omissions. The application of its contents of specific situations (including case studies and projections) will depend upon each particular circumstance. This publication is general in nature and has been prepared without taking into account the objectives or circumstances of any particular individual or entity. It cannot be relied upon as a substitute for personal financial, taxation, or legal advice. This article was produced on 02 July 2020. © Copyright 2020