Despite recent volatility, global share markets attractive for long term investors

By Tim Farrelly – CEO of Farrelly’s, and asset allocation consultant to Australian Unity Personal Financial Services

The past year has seen equities world-wide produce low or negative returns accompanied by much volatility. The main causes have been fears of rising interest rates in the United States and the threat of a US/China trade war.

Both are essentially short-term considerations and difficult to read.

A month ago, the market feared rising US interest rates but now that US interest rates are actually falling, the market is worried about the possibility of a recession. Short term forecasters can’t seem to win either way.

As for the trade war, one day it appears we have an agreement between the US and China, the next day all bets are off and share prices plummet. Good decision making under such uncertainty is virtually impossible for those interested in the short term.

On the other hand, making decisions based on long-term fundamentals is much more reliable. Based on fundamentals, we produce 10-year forecasts of market returns.

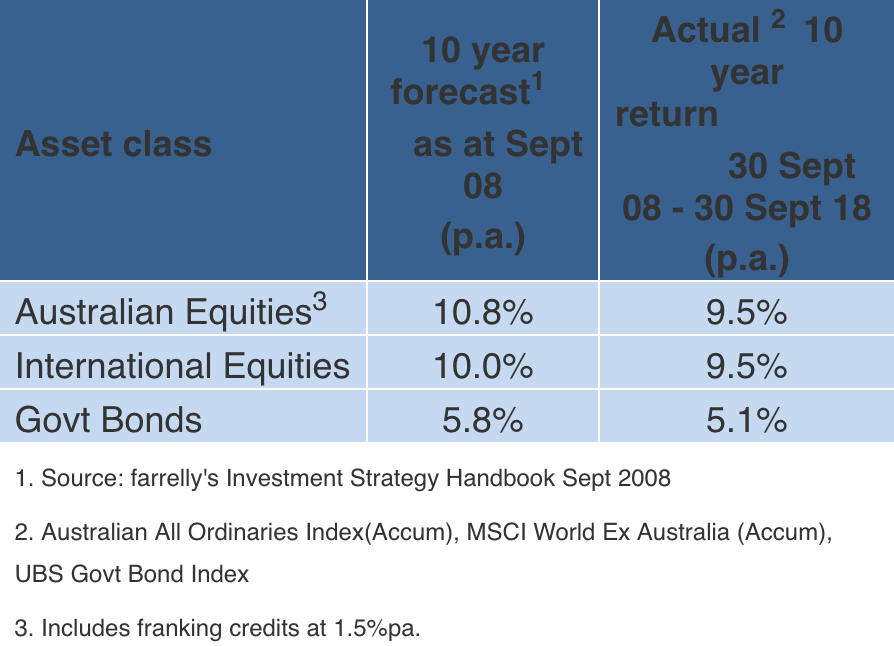

A good example of how this works in practice came in September 2008 during the Global Financial Crisis – a period of major volatility and fear. Despite that uncertain environment, our long term forecasts based on fundamentals proved to be very close to correct, as the table below shows (i.e. the 10-year forecasts we made at that time and the actual returns that subsequently were earned between September 2008 and September 2018).

Farrelly’s 10 year forecasts vs. actual:

While the temptation to go to cash at the time was significant; it would have been a very costly move. $100,000 invested in either international or Australian equities in September 2008 would now be worth $247,000 (with dividends re-invested). A cash investment of $100,000 would be worth just $135,000 (with income re-invested).

Even though the huge uncertainties caused by the global financial crisis and the wild gyrations that were occurring in the markets at that time were a black cloud for investors, our forecasts made a compelling case to remain invested in equities – even though further falls were still to come.

This is further proof that if you have quality investments and a long term horizon, it’s usually best to ignore the noise created by short term fluctuations in value, especially the noise coming from some in the mainstream media, and concentrate on returns for the long term.

What are our 10 year forecasts today?

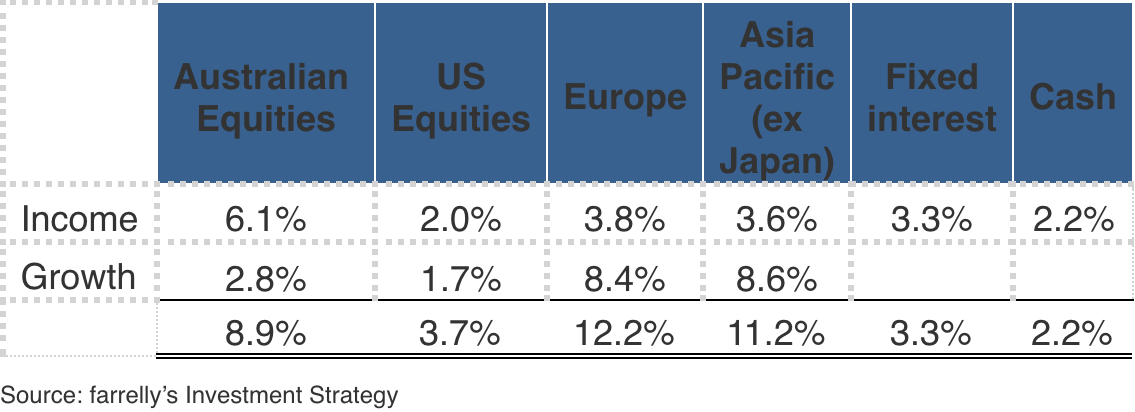

So, amidst all the recent volatility, how do markets look today? The table below shows that most equity markets are expected to comfortably outperform cash and fixed interest. The only market that looks marginal is US Equities. Here we are recommending lower than usual levels of investments. Elsewhere we remain very comfortable from a long-term perspective – regardless of the current short-term uncertainties and volatility.

Recent changes to state-based rules

So, amidst all the recent volatility, how do markets look today? The table below shows that most equity markets are expected to comfortably outperform cash and fixed interest. The only market that looks marginal is US Equities. Here we are recommending lower than usual levels of investments. Elsewhere we remain very comfortable from a long-term perspective – regardless of the current short-term uncertainties and volatility.

Expected returns 2018 to 2028:

Currently, in Europe and Asia investors pay around $11 for one dollar of profits – very low by historical standards, which means these markets are generally cheap.

Yes, there are concerns about the low growth of those economies but those concerns are more than offset by the low prices we have to pay for most of their shares at the moment.

Contrast those prices with the $19 we need to pay for a dollar of profits in the US. What’s more we believe the rate of growth in future profits is likely to slow.

In Australia we have sharemarket returns underpinned by a high level of dividends – currently around 6% (including imputation). While the expected economic growth in Australia is relatively low, it doesn’t really matter because the high level of dividends makes the total returns from quality shares appear reasonably attractive at the moment.

Disclaimer: This article is not legal or personal financial advice and should not be relied on as such. Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. You should obtain financial advice relevant to your circumstances before making investment decisions. Where a particular financial product is mentioned you should consider the Product Disclosure Statement before making any decisions in relation to the product. Whilst every reasonable care has been taken in distributing this article, Australian Unity Personal Financial Services Ltd does not guarantee the accuracy or completeness of the information contained within it. Any views expressed are those of the author(s) and do not represent the views of Australian Unity Personal Financial Services Ltd. Australian Unity Personal Financial Services Ltd does not guarantee any particular outcome or future performance. Taxation Information in this document should not be relied upon without seeking specialist advice from a tax professional. Australian Unity Personal Financial Services Ltd ABN 26 098 725 145, AFSL & Australian Credit Licence No. 234459, 114 Albert Road, South Melbourne, VIC 3205. This document produced in November 2018. © Copyright 2018