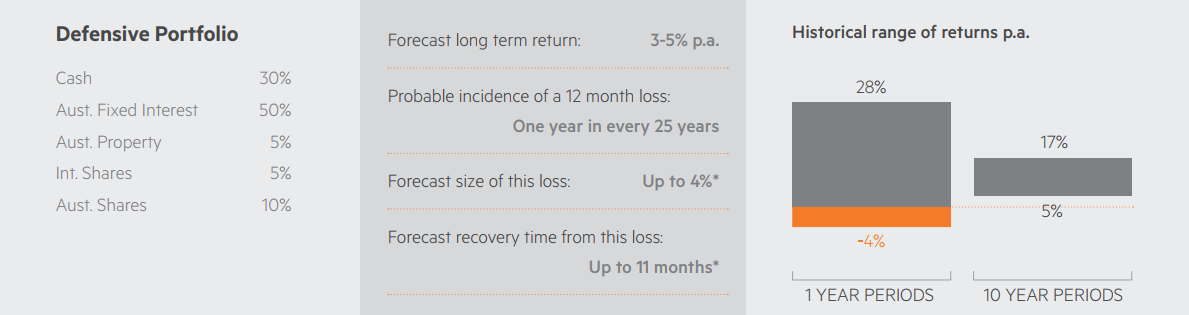

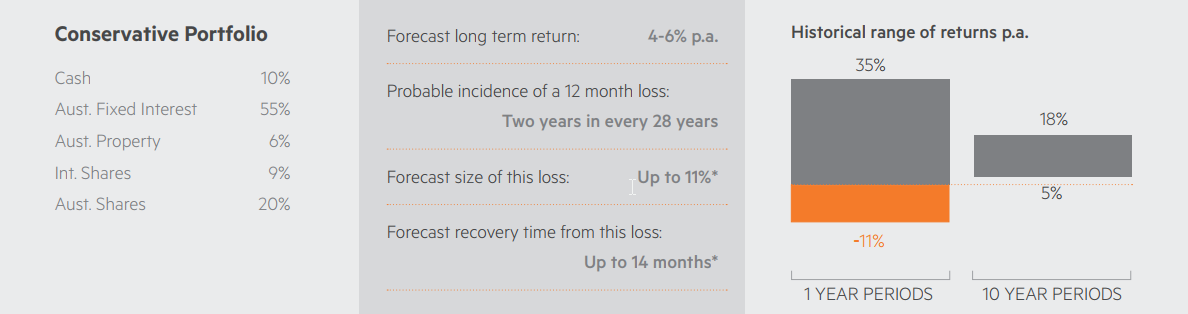

What is the Risk & Return Profile of your Investment Portfolio?

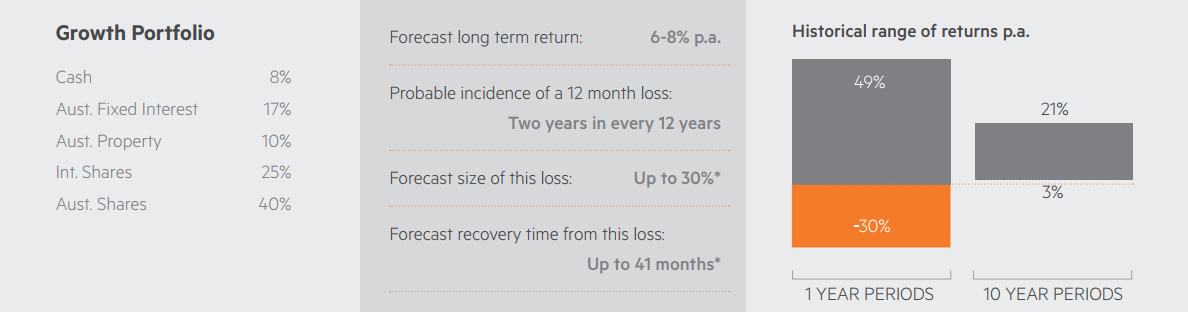

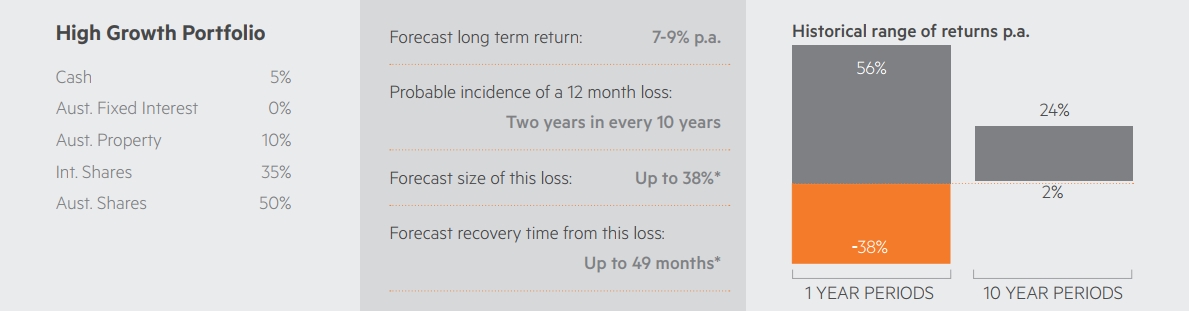

When assessing the performance of your investment portfolio, one should look at both risk and return. In this Fact Sheet, we outline what our study of 38 years of financial performance tells us about the long term risk/return profiles of five commonly used diversified portfolios. But remember, while past performance is instructive it isn’t necessarily an accurate indicator of future performance.

* The forecast size of loss and recovery are indicative only, based on the worst-case investment performance achieved in the last 38 years to 1 January 2017. Past performance is not indicative of future performance. Assumptions: These forecasts are based on composite asset class returns 1 Jan 1979 – 1 Jan 2017. Asset Class Indices: Australian Shares: S&P/ASX300 Accumulation Index. Australian Fixed Interest: UBS Australia Composite Bond All Maturities. International Shares: MSCI World Net Return $A. Australian Property: S&P/ASX300 Property Accumulation Index. Cash: UBS Bank Bill Index. Assumes portfolios are re-balanced monthly back to strategic asset allocation. Performance figures assume re-investment of returns.