COMPLICATED SITUATION,

SIMPLE ADVICE

SIMPLE ADVICE

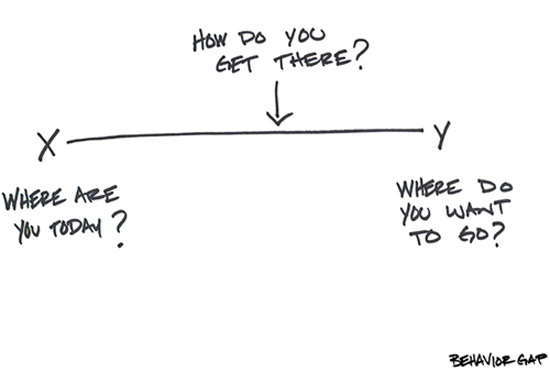

We don’t do guesswork. We do facts and figures and probabilities. Our approach to advice has been recognised and awarded, because it works.

WE WORK WITH THE QUIET ACHIEVERS

Our approach to advice isn’t based on the latest flashy financial product or get rich quick scheme. We believe in the fundamentals and extensive financial modelling of our clients’ situation, to remove doubt and provide certainty.

Want to get started immediately ?

Book a Strategy Session today and find out what’s possible.

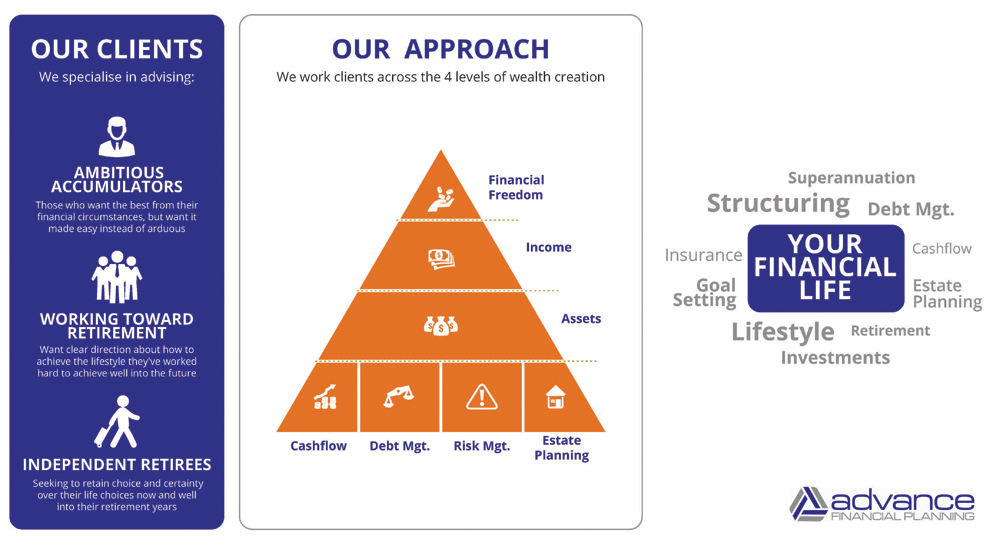

You want the best from your financial circumstances, but want it made easy instead of arduous.

You want clear direction about how to achieve the lifestyle you’ve worked hard to build well into the future.

You are seeking to retain options and certainty over your life choices now and well into your retirement years.

- Pre-retirees in their early 60s.

- Wanted to know if they could retire and still be able to achieve their dreams and the extensive travel they both wished to do.

- We determined that if they wanted to travel overseas every year they would have to work for another 12 months. If they were happy to travel overseas every second year they could retire now.

- The second alternative was to take on more risk in their portfolio – which they were not comfortable with.

- They decided then and there in the meeting that they would rather retire now and travel every second year.

- They have now been clients for approximately 3 years and are really enjoying their retirement and extensive travel.

- Retirees with an SMSF in their late 60s.

- They wanted assistance with appropriate investments as well as the administration and compliance requirements of running their SMSF.

- Also wanted to form a relationship with a financial adviser in the event that if the husband is unable to continue managing the SMSF they had a trusted adviser that could continue to provide ongoing advice and assistance to ensure that they can maintain their retirement standard of living.

- We advised them of an appropriate investment portfolio as their current investments would not have allowed them to maintain their retirement standard of living.

- We also provided them some advice on maximising their Centrelink Age Pension entitlements as well as providing recommendations around their Estate Planning needs.

- We implemented these recommendations and continue to work with them to ensure the portfolio meets their requirements.

- Gen X clients in their late 30s who initially came to see us to ensure they had the right level of protection for their family as they have two young children and a mortgage.

- We provided advice on appropriate levels of protection that was tax effective and did not impede on their cash flow.

- As a result of these discussions we also provided advice on estate planning, appropriate supers and investments within their supers to ensure they will be able to meet their retirement goals.

- At one of the Strategy Update meetings they indicated they wished to upgrade their home and considered the option of keeping the existing home as an investment property. We completed with them different modelling projection scenarios to see how much they could spend on a new home and yet still be able to maintain a comfortable lifestyle as that was one of their primary concerns.

- As a result they purchased a new home and made the decision to not keep their existing home as it would have affected their lifestyle. We determined an alternative strategy that could still build their wealth at the same level as maintaining their existing home as an investment property without impeding on their cash flow and lifestyle.

HOW WE WORK

OUR PROCESS

The Benefits of Financial Planning

Preparing to see a Financial Planner

Planning for your Retirement

Testimonials

MEET THE TEAM

George Tsakiris – Adviser | Managing Director

George established Advance Financial Planning in 2006 and was previously a Financial Planner with AMP Financial Planning. He is a Certified Financial Planner and a Self-Managed Super Fund Specialist Adviser with almost 20 years of experience as a Financial Planner. George is a current member of the Financial Advice Association Australia and the Self-Managed Super Fund Association.

George is passionate about providing holistic advice to his clients that is conflict free.

George lives locally in Research with his family who are all involved in the local Eltham Wildcats Basketball Club and Research Junior Football Club. George values keeping fit and healthy in both body and mind.

Britt Mueller – Financial Adviser

Britt joined Advance Financial Planning in July 2020 as a Paraplanner. In 2022, she took on more technical responsibilities and shadowed George in multiple areas of the business. Since successfully completing her Professional Year in March 2024, Britt is a fully qualified Financial Adviser. She holds Bachelor’s Degrees in Accounting and Economics (Majoring in Financial Planning).

Britt values working collaboratively with clients to determine the next steps on their financial pathway.

Britt lives in the Dandenong Ranges and enjoys playing basketball and values time spent with family and friends.

Jacob Ramsay – Paraplanner

Jacob joined Advance Financial Planning in July 2023. He was previously employed as a Client Services Officer with a boutique firm. He holds a Bachelor’s Degree in Financial Planning and is passionate about the industry and helping others.

His role as a Paraplanner includes preparing Statement of Advice and Record of Advice documents along with other financial planning documents.

Jacob lives locally in St Andrews and enjoys playing football for the Old Eltham Turtles and caring for the animals at his home.

Lisa Williams – Implementation Manager

Lisa joined Advance Financial Planning in February 2014 and has over 20 years’ experience in the financial services sector/superannuation.

Her role as Implementation Manager is to assist clients with implementation and administration duties.

Lisa lives locally with her family and in her spare time enjoys travelling, movies, dining out and watching her beloved Tigers in the AFL.

Sharon Northey – Office Manager

Sharon joined Advance Financial Planning in September 2016 with a background in marketing and administration within the financial services industry.

Her role as Office Manager is to assist clients, administrative duties and coordinate marketing and communications for the practice.

Sharon lives locally and enjoys being actively involved in her children’s sporting activities including the Research Junior Football Club.

LATEST NEWS

GET IN CONTACT

Contact Info

Advance Financial Planning Pty Ltd (ABN 42 489 063 051) is a corporate authorised representative of Personal Financial Services Limited (ABN 26 098 725 145) AFS Licence No. 234459, Level 10, 88 Phillip Street, Sydney NSW 2000. Fortnum Private Wealth Ltd respects your privacy. Refer to our privacy policy for more information.